THE “FUNDAMENTALS” OF THE US ECONOMY REMAIN WEAK …

|| By FITSNEWS || As the global economy warily eyes developments in Greece, fresh evidence from this side of the pond that cloudy skies are ahead.

You know, as opposed to rainbows and unicorns.

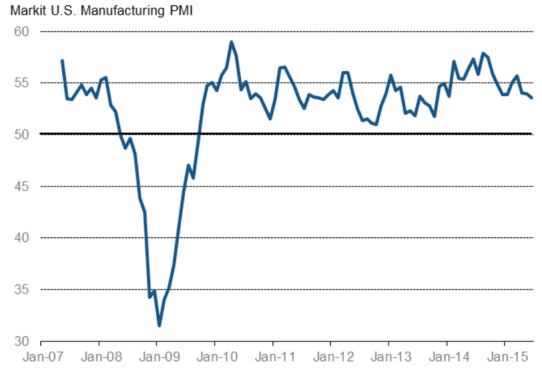

Markit’s June 2015 Purchasing Manager’s Index (PMI) clocked in at 53.6 (down from 54.0 in May) – its lowest level since October of 2013.

“Purchasing managers are reporting the slowest rate of manufacturing expansion for over a year and a half, suggesting that the economy is slowing again,” Markit’s chief economist Chris Williamson said.

Ruh-roh.

Here’s what the latest “New Normal” downtick looks like in chart form …

(Click to enlarge)

(Chart: Via Markit)

Hmmmm …

But hey (editor’s note: sarcasm ahead) … let’s follow the lead of Barack Obama and “Republican” leaders in Congress and subsidize the additional outsourcing of U.S. jobs via crony capitalist trade deals masquerading as “free trade,” right?

Because that’s exactly what the manufacturing sector needs right now … government carving out new incentives for multi-national corporations to shed American jobs.

Brilliant!

19 comments

Fits is right again today…school choice initiatives and the economy.Great job.Thumper can’t dispute this news on the economy.

Oh man, twice in one day. FITS is slipping, even the Haley zombie agrees with him!

It’s the “new”-“new” of a global economy – plain and simple

Accept and adapt to it or go the way of the dinosaur

The “new” economy is more like “pain and cripple.”

Going nowhere fast and it hurts.

Can’t argue with that but that’s the way it is…………

Probably will take a generation or two to sort itself out and by then the populace will be accustomed to the “new-“new” so it won’t be “new” anymore but the norm.

By then class distinction will be more pronounced and true upward mobility will be just a memory.

Anyone who passed Econ 101 might point out that the latest 0.4 drop in the PMI is indistinguishable from the “noise” of similar ups and downs over the last five years.

If this were a normal economy, the last 6 months would require that the FED lower interest rates. But we can’t…they are already at the bottom.

It is easy to diminish the new normal as the just the new normal, but believe you me these numbers have real consequence. Weaker jobs market, higher debt, less tax revenue…this stuff ricochets through the economy and has dire effects everywhere it goes.

Aint good. Nope, this aint good.

Precisely. Look at the Chart. This bump is no different than a dozen others in the last three years.

http://www.bloomberg.com/markets/economic-calendar

Best-time working I looked at the draft which said $9958@mk8

a….

http://www.FinanceWorksWorldClub/dream/maker...

Rorschach test? It looks like a cross between a fox and a cow.

Seriously dude…get some meds. This is definitely (hyper) critical thinking at its finest.

This is dated news, but was released today. For the 12 state southeast region, South Carolina had the highest personal income growth for 2013 at 2.5%, compared to 2.0% for the nation and was in the top ten for the nation.

http://www.bea.gov/newsreleases/regional/rpp/2015/pdf/rpp0615.pdf

This comes a week after South Carolina was 6th in the nation in the first estimate for 1st quarter personal income growth for 2015.

http://www.bea.gov/newsreleases/regional/spi/2015/pdf/spi0615_fax.pdf

Sic: Your Chicken Little view seems contradicted by today’s Reuters reports: “The Institute for Supply Management (ISM) said its index of national factory activity rose to 53.5 from 52.8 the month before, the highest level since January. The reading topped expectations of 53.1, according to a Reuters poll of economists. A reading above 50 indicates expansion in the manufacturing sector. New orders rose to 56.0 from 55.8. The gauge of prices paid was unchanged at 49.5, compared with expectations of 51.0.

Reuters also reported “U.S. construction spending rose in May to its highest level in just over 6½-years as outlays increased across the board, the latest sign of momentum in the economy. Construction spending increased 0.8 percent to an annual rate of $1.04 trillion, the highest level since October 2008, the Commerce Department said on Wednesday.”

Who’s right? Markit, a financial services company trying to sell itself, or Reuters reporting news from the Commerce Department and ISM?

I don’t trust either. Reuters is too close to too many multi-nationals. One of Markit’s clients is a major gold-trader. One other thing – factory output is a reflection of where businesses think the economy is going. They don’t count orders cancelled, nor correlate with actual final sales. Also, production was four times that of orders. What little good news there is in these figures, is in the mind of the unicorn.

Noooo… nonononono…. aaahhhhrhhrrrggghghghhgh!

*thump*

Pay Day for America is closer than most realize!

In other news: At a Volkswagen plant, the robots take first blood.

The first “Terminator”.

I am so horrified by the disfigured unicorn that I did not hear a word you said.