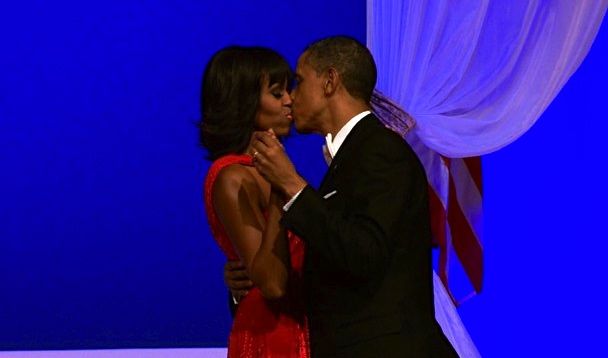

Obama Porn

Somebody cue Marvin Gaye … U.S. President Barack Obama and his wife, First Lady Michelle ObamaYou must Subscribe or log in to read the rest of this content.

Somebody cue Marvin Gaye …

U.S. President Barack Obama and his wife, First Lady Michelle Obama

11 comments

Will, you are obviously missing out on a hot genre here.

Finish your book of Nikki porn!

Your preoccupation with sex on this website is a sign of immaturity.

If you want to be considered a serious commentator, drop your jejune treatment of women & sex and focus on the important stuff.

No one cares about what titillates you.

until you realize that sex IS the important stuff, it is you suffering from immaturity. Sex and power and money are what make men go. Money, Power and sex are what make women follow.

I wonder if Barak will find and wear the bad luck tiki idol. Spiders, surfing accidents. Could be a great book.

Changing the subject, this was an email sent out yesterday.

From Jim Sinclair:

Hyperinflation in the US dollar is considered impossible by some.

Some of this opinion is motivated by the concepts and implications of the reserve currency facing such a challenge. Others deny that historical experiences of hyperinflation has causes, which dismisses the present problems of the US dollar as possible contribution to a hyper-inflationary experience.

The first opinion seems a product of misplaced patriotism rather than hard analysis. This because hyperinflation in a reserve currency, even if reserve by default, has implications to the fiat monetary system that most analysts consider too extreme to even consider. That is the US smack of flag waving over logic.

The second opinion would eliminate the Weimar experience because many see that as a direct product of war reparations Germany had agreed to. The common belief is that it was the war reparations that caused the hyperinflation, which is totally wrong, as presented. It was not the reparations, but the desire and decision to attempt to water the currency down to reduce the reparation costs that lead to the hyperinflation which followed.

The Weimar experience could have been different if the financial decision makers had been willing to suffer the pain of repayment over time and the attendant weight it would have placed on the economy. The decision to avoid the immediate pain of the cost of reparation via debasement of the currency is why the Weimar experience went into runaway hyperinflation.

In my opinion the decision in the Weimar experience was to debase the currency in order to offset reparations which then caused hyperinflation, not the reparations themselves. I believe it is exactly the same in modern times as the US financial decision makers adopted QE when Lehman Brothers failed in order to not face the consequences of that failure which was then the fraudulent mountain of OTC derivatives.

It is reasonable to assume that by midyear of 2013 the US Federal Reserve will have to make a decision in order to keep the US bond market which is US interest rates at the low levels that have been promised until employment has made a sustained recovery. I believe that the recent actions on the Fiscal Cliff and the Debt Ceiling would indicate the US Fed will increase the non-economic purchases (another definition of QE) of whatever amount of treasuries are offered for sale from any entity, sovereign or private.

This will be the entrance to the second phase of the gold market ascendancy. Gold got to $1900 on threatened systemic failure. Gold will go to $3500 and above on pure monetary fiat currency concerns. The actions of the Federal Reserve in order to maintain the extreme health of the US bond market are no different in their implications that Weimar financial moves were to avoid the economic pain of reparations or for that matter Zimbabwe’s constant Federal borrowing.

The Fed’s defense of the US bond market is demanded by the huge pile of original and old OTC derivatives that still haunt the monetary system as specific performance contracts with any financing floating in cyber space. This could drop the US dollar below .7200 to .5600 on the USDX in a short period of time. Because the dollar is a reserve currency by default (which means they have it already and are presently in position by historical acts) the potential snowball effect could ignite an inflation that will later be known as currency induced cost push inflation, which is a derivative of hyperinflation.

I anticipate that this is exactly what will happen propelling gold to new record heights starting no later than midyear this year and running into 2017. I am sure that this operation to keep a lid on gold is based on those that know what herein is outlined. The second phase of the long term bull market in gold should move faster and higher than any previous experience.

Sincerely,

Jim

Jim would not be in the business of selling gold, would he?

Sinclair has 32 million of his hard earned dollars in gold bullion.

I strongly suggest this blog, not a media outlet any more, to start publishing impact news stories rather than his typical Perez Hilton fan fair bovine sewage.

When the story commentators exceed the quality of story material, then you have a product that will soon fail

I believe that video would be in the bestiality section.

Firmly ensconced in the back seat of the Chrysler van, Will took a long swig from the can of Pabst Blue Ribbon beer. Letting go with a loud belch, he opened the sliding door and stepped out into the cold night air. In a demonstration of his manliness, he tried, with no success, to crush the can with one hand…end on end. He couldn’t help but notice the smirk on his lovers lips. “What’s the matter, Willy Boy? Did I sap all of your precious bodily fluids,” she blurted out.

Tossing the beer can aside, Will ignored her taunts and even managed a laugh when she pulled a vibrator out of her purse and proceeded to massage the inside of her thighs with the pulsating device. “Go easy on that thing, Nikki Babe,” Willy said. “You know the batteries are running low!”

She pouted and turned to watch in amazement as Will whipped out his tired old steed and released a stream of pee-pee onto the cement in the shape of a heart. He even had enough steam to write her name below it. “You forgot to dot the i, sweetheart,” said a disappointed Nikki. “So I did,” Will interjected, “so I did.”

He then walked around and surveyed his workmanship. Looking his disappointed lover in the eye, he raised his left hand, and, leaning over, he put his index finger over his left nostril and sprayed a perfect snot ball onto the cement exactly where he meant to put it.

She applauded with glee at her lover’s extraordinary effort in wooing her.

“Time for another beer,” said Will as he wiped the remnants from his upper lip with his shirt sleeve and reentered the van, reinvigorated and raring to go. “Someday, I’m gonna write a book about this,” he said. “Yup, someday…

You should be his ghost writer!

NYT Bestseller