|

Getting your Trinity Audio player ready...

|

South Carolina’s tax climate is not competitive – especially for small businesses and individual income earners. As I have often written, the Palmetto State’s punitively high tax on income – the highest in the southeast – is a direct disincentive to job growth and earnings.

It erodes our prosperity, in other words – especially given the strides our neighboring states have made (and are continuing to make) when it comes to lowering their top marginal rates.

No wonder businesses in South Carolina are struggling … and the state’s employment economy is lagging behind the rest of the nation.

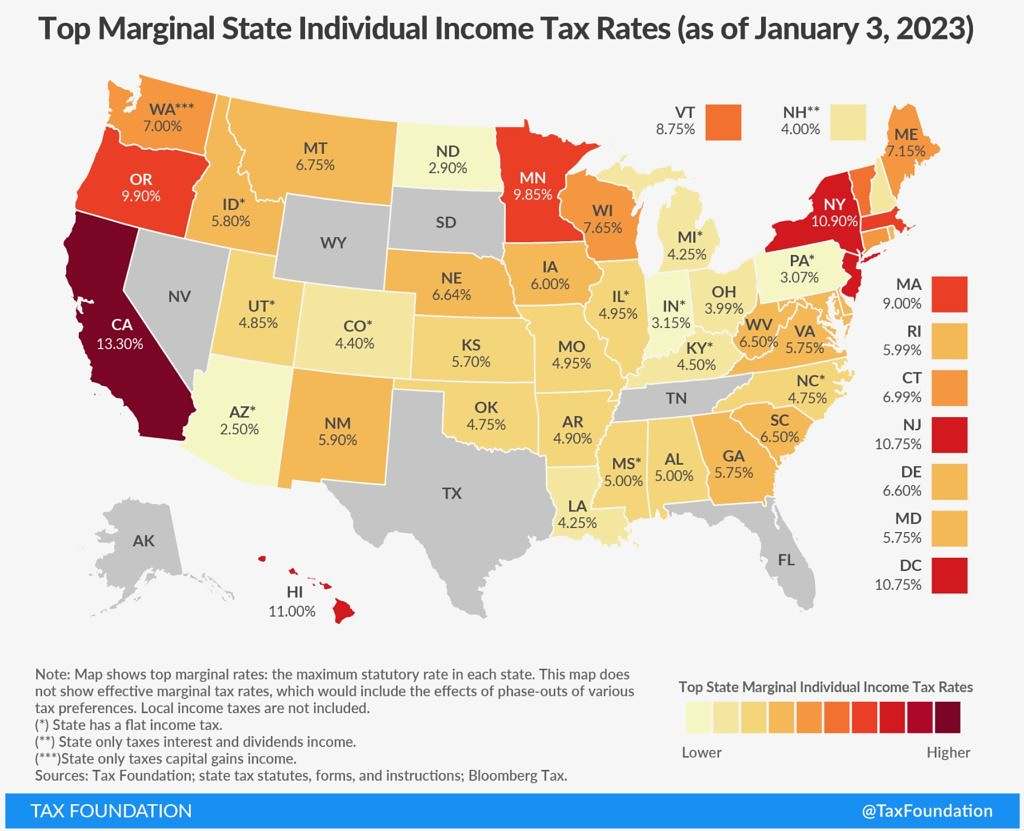

According to the Tax Foundation, the Palmetto State’s top marginal rate of 6.5 percent is the fifteenth-highest nationally. But as previously noted, it is the highest in the southeast region. Also seven states – including Florida, Tennessee and Texas – have no state-level income tax.

(Click to view)

Not surprisingly, their economic growth is rapidly outpacing South Carolina’s …

On the sales tax front, South Carolina has the eighteenth-highest burden nationally with an average levy of 7.5 percent – again, according to the latest data from the Tax Foundation. Tax rates range from 6 percent – the state’s base rate – to 9 percent in certain counties and municipalities.

This weekend, though, an annual gimmick will result in the elimination of the sales tax on a host of different items for three days – part of a bid by South Carolina politicians to make people forget the 362 days when they are forced to pay

According to the S.C. Department of Revenue (SCDOR), the three-day sales tax exemption applies to “clothing and accessories; footwear; school supplies used for school assignments; computers, software, and printers; certain bed and bath supplies.”

You can view the full list of exempt items here …

***

The holiday runs from midnight Friday (August 4, 2022) – and extends for 72 hours until midnight on Sunday (August 6, 2022). According to SCDOR officials, the three-day holiday typically generates between $2 million to $3 million in relief for Palmetto State taxpayers – although between 2016-2020 it generated less than $2 million in “savings” annually, on average.

By contrast, “Republican” lawmakers have grown government from $26.3 billion to $38.8 billion since 2016 – a whopping 47.5 percent increase.

I’ve historically taken a dim view of this gimmick, arguing this so-called “holiday” was not providing substantive relief, but rather giving fiscally liberal politicians a talking point.

“I am glad South Carolina’s ‘leaders’ are providing us with 72 hours of tax relief,” I wrote last year. “It is the other 8,688 hours of the year I am worried about, though.”

Rather than invest in our people and our businesses by providing broad-based tax relief for all income-earners, “Republican” supermajorities in South Carolina have taken their money and blown it on bloated bureaucracies and market-distorting crony capitalist subsidies.

Not only is such government waste and corporate welfare unfair, it has proven utterly ineffective at improving all manner of important outcomes for the people of this state. Until that changes, don’t expect those outcomes to change – no matter how many “gimmicks” state government throws at its citizens.

***

ABOUT THE AUTHOR…

Will Folks is the founding editor of the news outlet you are currently reading. Prior to founding FITSNews, he served as press secretary to the governor of South Carolina. He lives in the Midlands region of the state with his wife and seven children.

***

WANNA SOUND OFF?

Got something you’d like to say in response to one of our articles? Or an issue you’d like to address proactively? We have an open microphone policy! Submit your letter to the editor (or guest column) via email HERE. Got a tip for a story? CLICK HERE. Got a technical question or a glitch to report? CLICK HERE.

2 comments

Tax relief? How about living wages. Our Public Servants, retired and active duty, all received over 15% in cost of living adjustments in as many as 4 years. Teachers are now at a southeastern minimum entry level, finally. Another COLA bump is unjustified with out a state minimum wage increase to 10.00 an hour.

Conservatives will always whine about the sliver of your wages that get pickpocketed by the state, some of which does get returned to you via government programs and services, but gloss over capital clubbing you in the back of the head and making off with a massive chunk of the value of your labor for nothing beyond their own profits.

Class traitors like Will are useful to capital in that they always keep your mind focused on the sliver and not the chunk. They are part of the team responsible for robbing you.