We all know U.S. president Joe Biden is struggling these days. Hard. He had another serious senior moment at a high-profile press event last week – with the latest gaffe drawing the scrutiny of none other than The New York Times.

“His speeches can be flat and listless,” Times reporter Peter Baker noted. “He sometimes loses his train of thought, has trouble summoning names or appears momentarily confused.”

Appears?

Baker was far kinder to Biden than he could (should?) have been, but America’s 46th president appears increasingly unfit for duty … both physically and mentally. And more frequently, the ones calling him out for his lack of fitness are the same media mouthpieces which propelled him to the presidency less than two years ago.

The same outlets which helped bury his scandals …

Anyway … I personally don’t care whether Biden is a vegetable or a rocket scientist. He could be as sharp as a tack or as dumb as a box of rocks and it would make absolutely no difference to me. What I care about are outcomes – and the policies which produce them.

Which brings me to yesterday’s release from the U.S. Bureau of Labor Statistics (BLS) on the latest inflation data. According to the numbers (.pdf), the consumer price index (CPI) climbed by 1.3 percent during June – the largest monthly increase since 2005. Meanwhile, the year-over-year data show a 9.1 percent increase – the largest on record since 1981.

Looking inside the data, energy costs were once again driving the spike – although rent climbed by 0.8 percent, its largest monthly jump since April of 1986.

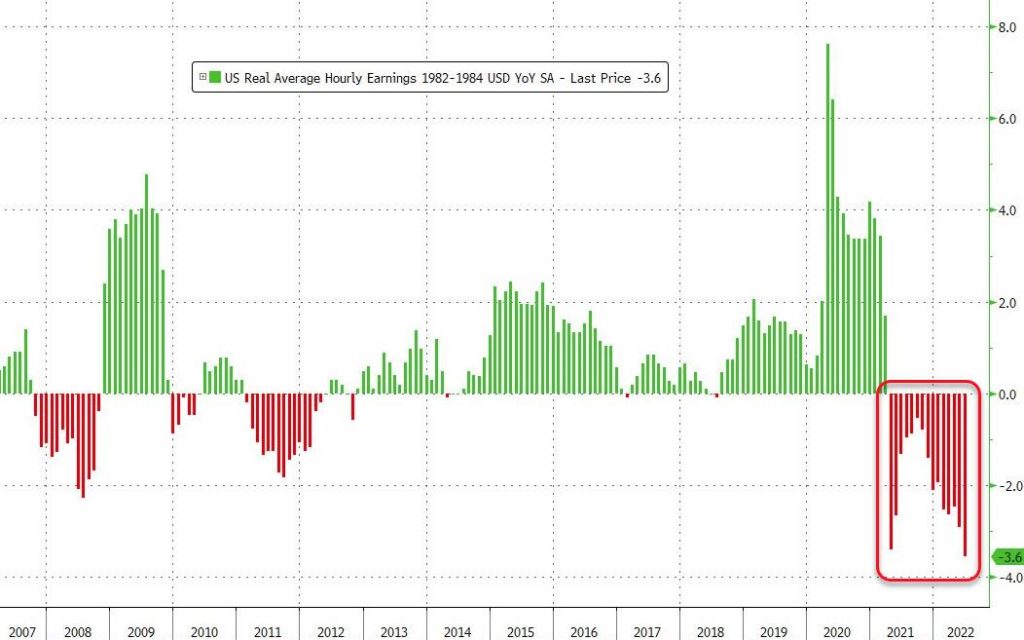

Arguably the most depressing data point? Real wages …

According to BLS, they fell for the fifteenth consecutive month.

Take a look at this depressing chart courtesy of our friends at Zero Hedge …

(Click to view)

(Via: Zero Hedge)

Given this steady dip, Americans’ purchasing power is down 3.6 percent on an annualized basis from last June.

Two months ago, I noted many Americans had turned to credit card debt in the hopes of making ends meet amidst soaring prices. Credit card debt reached a new monthly record in March, but this new debt has slowly receded as these cards have been maxed out.

Total consumer credit rose by “only” $22.3 billion during May – down from March’s record high of $47.5 billion. Meanwhile, revolving debt (i.e. credit cards) rose by $7.4 billion in May – down from March’s record of $25.9 billion.

In other words there will be no margin for error when the recession hits …

Biden’s plan to combat inflation? So far it has relied exclusively on the “independence” of the secretive Federal Reserve bank – which has been spiking interest rates in the hopes of containing the price hikes.

Will it work? No … in fact, most believe the Fed’s efforts to tighten the money supply will only exacerbate the problem.

***

THE DATA …

(Via: BLS)

***

ABOUT THE AUTHOR…

(Via: FITSNews)

Will Folks is the founding editor of the news outlet you are currently reading. Prior to founding FITSNews, he served as press secretary to the governor of South Carolina. He lives in the Midlands region of the state with his wife and seven children. And yes, he has LOTS of hats (including that Durham Bulls’ lid pictured above).

***

WANNA SOUND OFF?

Got something you’d like to say in response to one of our articles? Or an issue you’d like to address proactively? We have an open microphone policy! Submit your letter to the editor (or guest column) via email HERE. Got a tip for a story? CLICK HERE. Got a technical question or a glitch to report? CLICK HERE.