This is a news analysis.

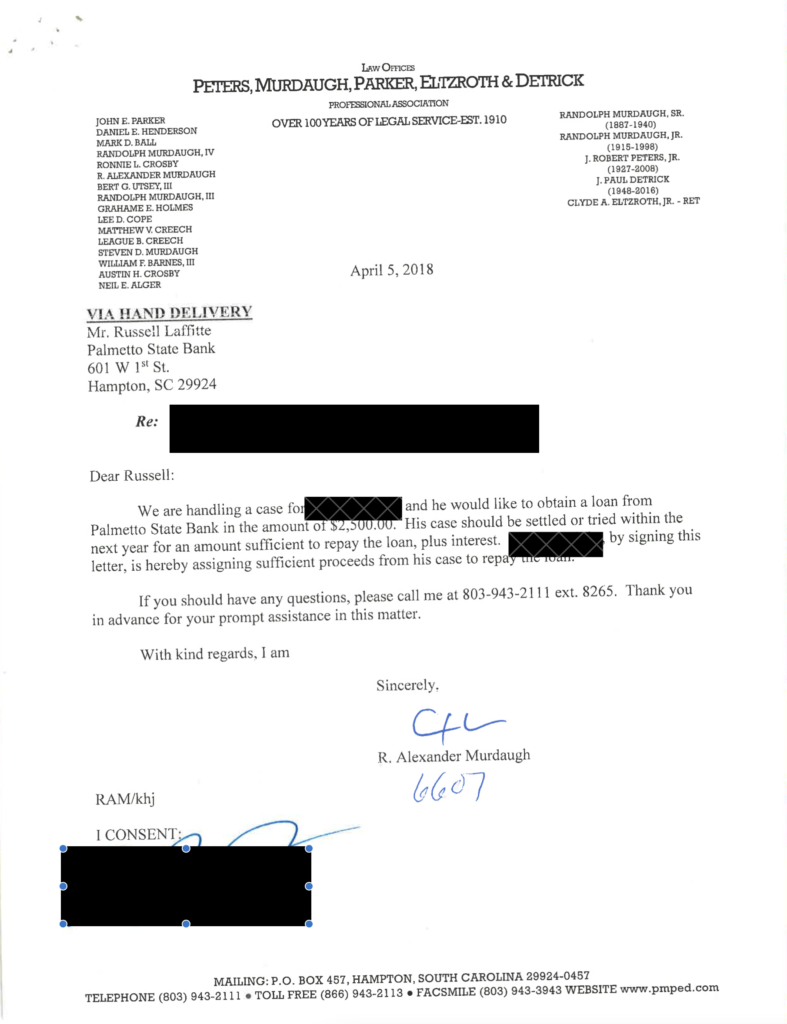

In a February deposition, Chad Westendorf, the vice president of Palmetto State Bank, testified that his bank routinely issued something called “lawyer loans” to clients of Alex Murdaugh and Murdaugh’s former law firm, Peters, Murdaugh, Parker, Eltzroth and Detrick.

According to bank documents and correspondence obtained by FITSNews, the loans were given to Murdaugh’s clients for “personal expenses” while they were awaiting the outcomes of their cases.

These were short-term, high-interest loans that, in some cases, would nearly double by the time they could be paid off with the settlement money — usually well past the expected pay-off date.

Sources close to the situation say that Murdaugh, in some instances, suggested these loans to clients and sent them to the bank for help.

Though the loans were technically “unsecured,” they were, in essence, backed by Murdaugh’s signature — or the signatures of his associates — on PMPED letterhead.

Murdaugh’s facilitation of these loans is problematic for several reasons:

Lawyers have a duty to protect their clients …

One could argue that arranging for high-interest loans against what at the time was (for all intents and purposes) imaginary money, would not be considered “protecting” a client.

In fact, such a practice could have created more distress for clients if the settlement money hadn’t come through.

The loans, depending on the amounts, could also eat up a significant portion of a client’s bottom line.

“You don’t point your client to Don Corleone and say ‘Hey, he’ll loan you money! I called him. He’s there waiting for you,'” Columbia attorney Eric Bland said of the practice. “You’d be turning your client over to a predator. The only difference between the bank and Corleone is he has a gun on his waist.”

***

Murdaugh seems to be skirting the rules …

The South Carolina Rules of Professional Conduct prevent lawyers from “[subsidizing] lawsuits or administrative proceedings brought on behalf of their clients, including making or guaranteeing loans to their clients for living expenses, because to do so would encourage clients to pursue lawsuits that might not otherwise be brought and because such assistance gives lawyers too great a financial stake in the litigation.”

Lawyers in this state are not permitted to loan clients money nor are they allowed to guarantee payback of any loans.

This rule is in place to preserve the integrity of the attorney-client relationship and not turn lawyers into creditors.

Practically speaking, it also prevents law firms from “buying” their customers to undercut their competition. Murdaugh’s arrangement with Palmetto State Bank could have incentivized potential clients to choose him as a lawyer, knowing he’d get them money now, over a lawyer who has no such relationship with a bank.

While Murdaugh is not accused of directly loaning money to his clients, facilitating loans through a middle man could be seen as a work-around to the state’s rules, especially given the letters he appears to have had hand-delivered to the bank to vouch for the clients’ potential future settlements.

In the letters, there is a line that says, “[His/Her] case should be settled or tried within the next year for an amount sufficient to repay the loan, plus interest.”

While there is no promise that Murdaugh or the law firm would repay the loans for clients in the event their settlements don’t materialize, the letters appear to serve as unofficial collateral for the loans.

***

***

In his February deposition with Bland, Westendorf testified that the “lawyer loans” were always repaid.

Bland: To your knowledge, you know, what happens if they weren’t repaid? Did you guys ever go after the client or you would just write off the loan?

Westendorf: I don’t know.

Bland: In your experience, the loans that you wrote, were they all paid?

Westendorf: They were all paid. I don’t know —

Bland: They do a pretty good job — Murdaugh does a pretty good job of collecting money.

Westendorf: Well, I mean, yeah.

Bland: Because you’re paid from the settlement proceeds.

Westendorf: That’s correct.

Bland: And then it’s calculated based on when the loan started to when the repayment happens.

Westendorf: Correct.

The loans were typically due to be paid back in a year, according to Westendorf. But cases can take years to settle or go to trial.

This means that the loans were set up in a way that all but guaranteed the bank would receive additional fees and interest, as well as penalties.

When the settlements or jury awards came through, the loans would be paid in full with that money by the law firm.

***

***

Personal conflicts of interest …

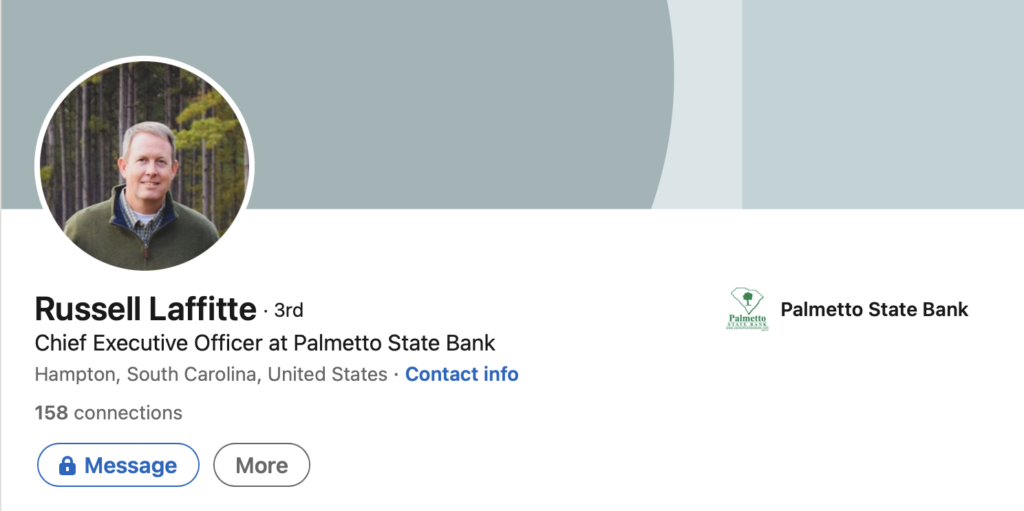

Murdaugh had an apparently very close and enterprising relationship with Russell Laffitte, the former CEO of Palmetto State Bank.

Laffitte, whose family has owned the bank for generations, is connected to several cases in which Murdaugh’s clients allegedly had settlement money stolen. He was fired by the board when news began to emerge of his involvement in Murdaugh’s cases.

It was therefore under Laffitte’s authority that these “lawyer loans” were granted to Murdaugh’s clients.

The “lawyer loans” appear to have given the bank sizable rates of return on its investments. Meaning, Murdaugh seems to have provided his friend with a steady stream of indebted customers from whom he could generate all but guaranteed income.

Putting the issue of stolen money aside, this relationship would likely have been considered a personal conflict of interest and, therefore potentially in violation of the South Carolina Rules of Professional Conduct.

“The lawyer’s own interests should not be permitted to have an adverse effect on representation of a client. For example, if the probity of a lawyer’s own conduct in a transaction is in serious question, it may be difficult or impossible for the lawyer to give a client detached advice. … In addition, a lawyer may not allow related business interests to affect representation, for example, by referring clients to an enterprise in which the lawyer has an undisclosed financial interest.“

The Laffitte-Murdaugh business arrangement — again, putting aside the issue of stolen money — raises these questions: What did Murdaugh get out of the arrangement? Was there a financial incentive for him? Or did these loans result in friendlier, more lenient treatment when Murdaugh needed a loan from the bank or other favors?

***

***

When one considers the issue of stolen money, however, the questions become: Did the “lawyer loan” arrangement result in a better ecosystem for Murdaugh’s alleged financial schemes to go undetected for so long?

Up until 2015, Murdaugh appears to have used Palmetto State Bank to embezzle money from his client trust fund by having checks made out to the bank — which ostensibly was managing the money for Murdaugh’s clients.

Murdaugh then allegedly converted this checks into money orders in amounts that likely would have raised eyebrows at other banks.

Did the “lawyer loans” help keep the bank from biting the hand that was feeding it?

As a lawyer, Murdaugh was obligated to advocate for his clients …

According to Westendorf’s testimony, Murdaugh and PMPED aren’t the only ones who facilitated “lawyer loans” at Palmetto State Bank.

However, during weeks of interviews and research, FITSNews has repeatedly been told by lawyers across the state that this is not a common practice outside the 14th Judicial Circuit.

While a cottage industry of pre-settlement financing has arisen over the past decade or so, lawyers with whom FITSNews has spoken say they generally try to discourage their clients form obtaining personal loans that are tied to their cases and certainly don’t suggest that they get them.

“It’s a nasty business,” one lawyer said.

State Rep. Justin Bamberg, who represents several alleged victims of Murdaugh, said helping clients get high-interest loans goes against a lawyer’s professional obligation.

“Our job as attorneys is not to tell clients what they want to hear or pander to them just to make them happy. Our job is to protect them and their interests, even if that means telling them, ‘You’re gonna have to struggle a bit longer because I can’t let you cut your nose off to spite your face financially,'”

If a client is intent on obtaining a pre-settlement loan, however, Bamberg and others say they would advocate for their client to get a lower rate.

In the case of Murdaugh’s clients, they were given APRs as high as 29.800%, according to promissory notes from 2014, 2015 and 2018 reviewed by FITSNews.

Because the loans were sure to be paid back — Westendorf himself said he couldn’t remember a time when they weren’t — Murdaugh could have, according to lawyers whose clients have been affected by these loans, advocated for a lower interest rate from Palmetto State Bank.

But it doesn’t appear he did.

“It is unconscionable,” Bamberg said. “It clearly looks like Palmetto State Bank was in a joint venture to make money on these folks cases because no lawyer should ever let his or her client be subject to interest rates that high. This is just another example of corporate and privileged greed costing people in need.”

***

***

Many residents in Hampton, Allendale, Jasper and Colleton counties — four of the five counties that make up the 14th Circuit — live at or below the poverty rate. Generally speaking, they have far fewer options when it comes to securing loans.

One lawyer familiar with the financial realities of the typical personal injury client in these counties said an arrangement such as the one Murdaugh had with Palmetto State Bank would be the lesser of two evils for a lot of people.

The lawyer cited the absurdly high interest rates of payday loans and pawn shops, which some clients resort to using while awaiting their settlements.

“When their settlement comes in, and a lot of times these are not big settlements, some clients are left with nothing because pawn shops and payday loans are charging so much interest.”

Another lawyer called Murdaugh’s arrangement a “clear conflict” and said even if it was a better option for some people, lawyers shouldn’t be facilitating loans like this.

“It’s not a good idea. It’s such a land mine.”

Sharks in the water …

For generations in Hampton County, it’s said that a certain cabal of lawyers has controlled it all: the juries, the courts, the cops, the banks, the elections, the local governments, as well as the outcomes.

With this stranglehold, this small group created an economy where the chief industry is insurance money.

Several adjusters from across the state — both current and former — have shared stories with FITSNews about their dealings with this Hampton County cabal.

And they all sound like this:

“Everyone knows how corrupt it is down there. Limits are paid out all the time on claims that anywhere else would settle for far, far less. They boast and flaunt their ‘power.’ And all the while they are only hurting the residents there, and driving up premiums for everyone.”

With a system like the one in Hampton County, one wonders what legal work Murdaugh actually did beyond leveraging his power and signing paperwork.

Multiple sources close to the investigations into Murdaugh’s alleged schemes have told FITSNews that in addition to taking settlement funds, Murdaugh is also suspected of artificially inflating the costs associated with his cases, as well as taking loans from client accounts at Palmetto State Bank with suspiciously low interest rates and nebulous terms for paying back the money.

While the scope of his alleged thefts is not yet known — nor is the full complement of his alleged co-conspirators — it appears Murdaugh created a sub-economy and exploited all the ways an unscrupulous attorney can help himself to a client’s money.

It’s not clear how the high-interest loans fit into his alleged schemes, but this much is true:

If a settlement check were a fish, it would be the big one that Santiago in “The Old Man and the Sea” hooked despite his long spate of bad luck and his meager equipment.

It would be the fish he tried to tow ashore because his skiff was too small and his body too weary to haul it in properly.

And Alex Murdaugh — as well as his alleged co-conspirators — would be the sharks in the water below, seizing the opportunity, taking what was never theirs and mercilessly stripping that fish down to its bones, oblivious of the man above them who had suffered for it.

*****

ABOUT THE AUTHOR …

(Via: Provided)

Liz Farrell is the new executive editor at FITSNews. She was named 2018’s top columnist in the state by South Carolina Press Association and is back after taking a nearly two-year break from corporate journalism to reclaim her soul. Email her at liz@fitsnews.com or tweet her @ElizFarrell.

***

WANNA SOUND OFF?

Got something you’d like to say in response to one of our articles? Or an issue you’d like to address proactively? We have an open microphone policy! Submit your letter to the editor (or guest column) via email HERE. Got a tip for a story? CLICK HERE. Got a technical question or a glitch to report? CLICK HERE.