Henry McMaster Proposes Tax Cut For Veterans, Law Enforcement Retirees

A good idea, but still “gimmick relief” that falls short of substantive, stimulative tax cuts …

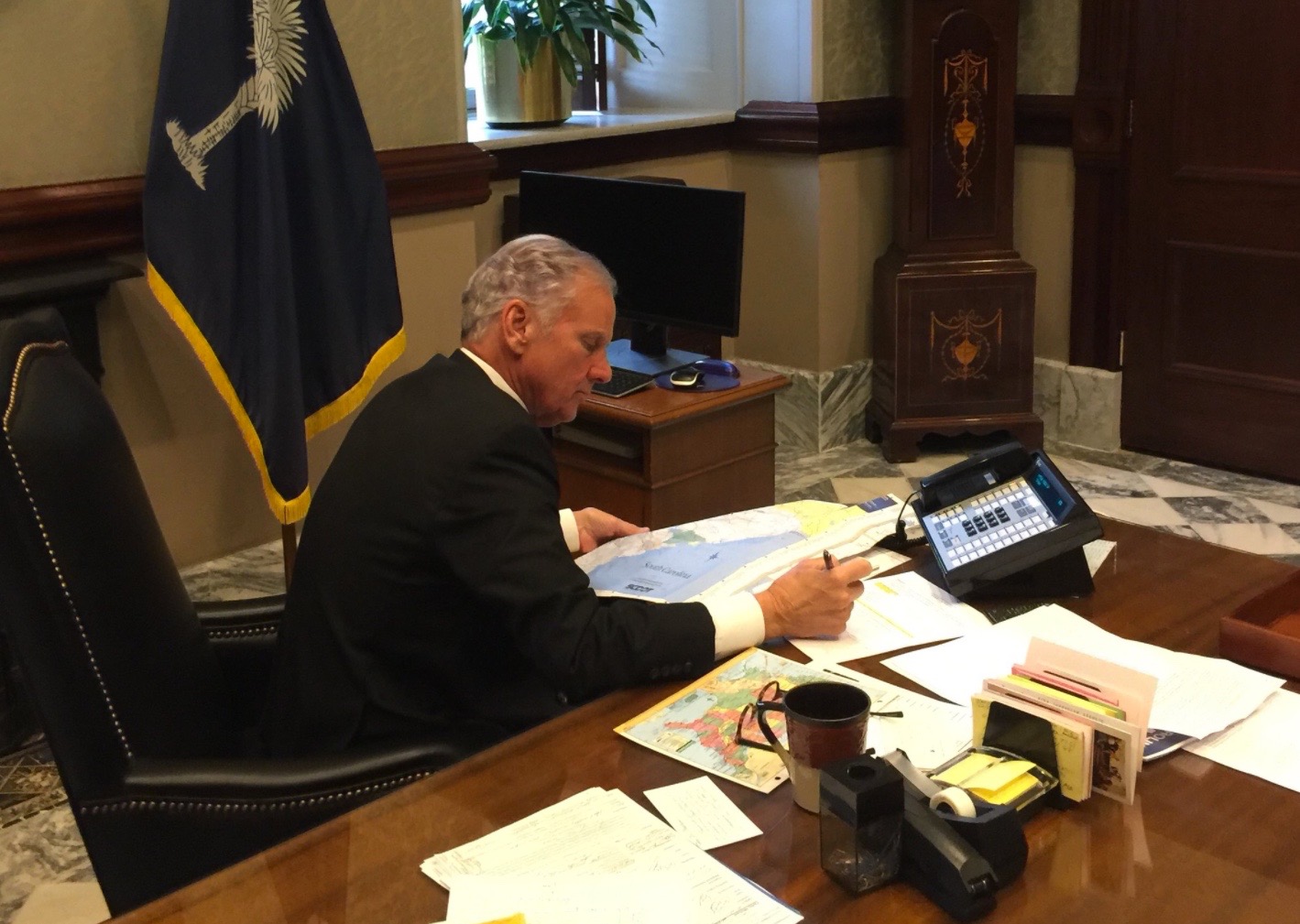

South Carolina governor Henry McMaster wants to permanently exempt military veterans and retired law