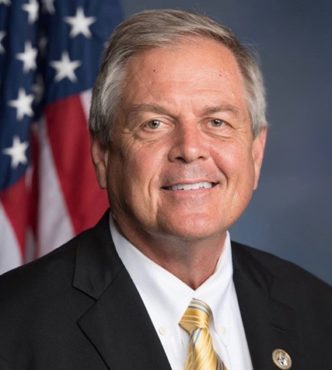

by RALPH NORMAN || Recently, the House Republicans passed the Tax Cuts & Jobs Act. One of my top priorities this Congress was to help pass comprehensive tax reform, and this bill does just that by overhauling our complex tax code for the first time in 31 years. It is an encouraging moment as Congress takes one step closer in providing a better future for every American. Our objectives are straightforward: we aim to deliver more jobs and bigger paychecks for American workers, through a fairer and simpler tax code.

Here is why I voted for the Tax Cuts & Jobs Act:

Did you know taxpayers spend roughly $99 billion and 2.6 billion hours each year complying with individual income taxes? This is absurd, simply put. Average Americans deserve a fairer and simpler tax code. You deserve to live your life independently, have a good paying job, and keep more of your hard-earned dollars without thinking that the tax code is rigged against you in favor of Washington, D.C. elites. By throwing out the loopholes and consolidating deductions, our plan will make filing taxes as simple as filling out a postcard.

Our tax plan is also pro-family. Hardworking men and women across this country deserve to keep more of their paychecks. That’s what our plan offers: bigger paychecks. This bill ensures Americans keep more money in their pockets, and less money being sent to Washington. Individual rates are lowered for low- and middle-income Americans to zero percent, 12 percent, 25 percent, and 35 percent. The standard deduction is doubled to $12,000 for individuals and $24,000 for married couples. A family of four making $59,000 will receive a tax cut of $1,182. Middle class families in South Carolina will see an income increase of $2,391. That means more money for you and your family to spend, save, and take care of what matters most to you.

If you have children, the benefits will be even greater: Our plan increases the child tax credit from $1,000 to $1,600. Children are our future and they need all the support they can get. This will help parents with the cost of raising children. We also create a new family tax credit of $300 for those who don’t qualify for the child tax credit like an elderly family member. Now, every family can take advantage of this write-off who has a parent or family member that they are providing care for.

Our plan will bring jobs to America. For too long, “Made in America” has been an unrealistic goal for many businesses. Our country has one of the worst tax codes in the industrialized world for businesses small and large. Businesses are forced to close up shop or go overseas because it’s cheaper. We want jobs to come to America and to stay in America. We want entrepreneurs to grow their businesses and hire people in their communities. Since the release of our plan, AT&T has promised to increase investments in the U.S. by $1 billion dollars if our tax reform bill becomes law. We want to encourage businessmen and women to invest their capital right here in the U.S. By reducing tax rates and simplifying the tax code, our plan will help make America the jobs magnet of the world.

Our plan makes America competitive again. Lowering the corporate tax rate from 35 percent to 20 percent will do just that. The cost of corporate taxes are paid by everyone in the form of higher prices and lower wages.

Our plan will have farmers, small and large businesses see a tremendous boost in growth by including an immediate expensing of capital investments into the tax code. A farmer can purchase a tractor, truck, and additional equipment to expand his operations. A mechanic will be able to add another bay to his shop. Both can immediately write them off their taxes immediately. This means business owners can continually reinvest in their business and expand.

For those opposing the Tax Cuts and Jobs Act, I want to remind you that The Washington Post recently fact-checked the claims that all middle-class families would face higher taxes. And guess what? The Washington Post gave those claims “4 Pinocchios”! (Their 1-5 scale of false claims is measured by a “Pinocchio”). This bill will give over 80 percent of hard-working families tax cuts they deserve to have their well-earned money returned to them.

In the end, as with every piece of legislation – both Republican and Democrat – this bill is not perfect. I think lowering the capital gains tax would benefit more Americans. As a South Carolinian, I understand limiting the state income tax deduction at $10,000 isn’t ideal. As a businessman, if we are going to negotiate every provision that could be improved, we will never reform our antiquated, complicated tax code. It needs to be done, Americans deserve better than the status quo.

We must not let the pursuit of the perfect outweigh the attainment of the possible.

Pro-growth tax reform is a priority. After listening to people across the 5th District, I am committed to working tirelessly to deliver a tax reform bill to President Trump’s desk. Let’s work together to create jobs, increase paychecks, grow our economy, and improve lives.

Ralph Norman is a businessman from Rock Hill, S.C. He represents the Palmetto State’s fifth congressional district in the United States House of Representatives.

***

WANNA SOUND OFF?

Got something you’d like to say in response to one of our stories? Please feel free to submit your own guest column or letter to the editor via-email HERE. Got a tip for us? CLICK HERE. Got a technical question? CLICK HERE. Want to support what we’re doing? SUBSCRIBE HERE.

Banner: iStock