SCARY LABOR PARTICIPATION DATA …

We’ve written a lot about the labor participation rate being the real employment indicator to watch.

Why? Because labor participation is the real employment indicator to watch.

Unlike the unemployment rate – which tracks a segment of workers within the labor force – the labor participation rate tracks the size of the workforce itself (as a percentage of a country’s working-age population).

That makes it a far better indicator of the extent to which people are gainfully employed.

Looks like Jamie Dimon – chairman and CEO of JP Morgan Chase – agrees with us. In his annual letter to shareholders (.pdf), Dimon pointed to a particularly troubling number within the broader labor participation rate.

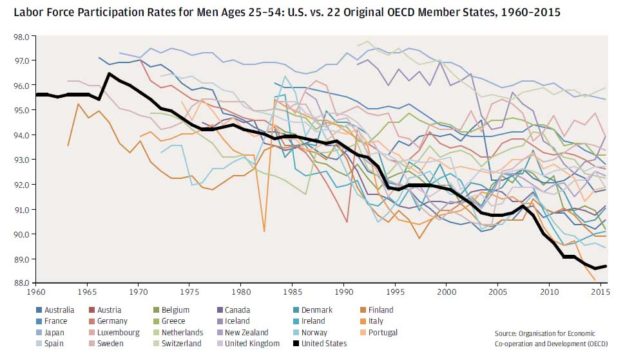

“Labor force participation in the United States has gone from 66 percent to 63 percent between 2008 and today,” Dimon noted. “Some of the reasons for this decline are understandable and aren’t too worrisome – for example, an aging population. But if you examine the data more closely and focus just on labor force participation for one key segment; i.e., men ages 25-54, you’ll see that we have a serious problem.”

And what is the problem?

In the United States, labor participation rate for this group has dipped from 96 percent a half century ago to a little over 88 percent today.

“This is way below labor force participation in almost every other developed nation,” Dimon noted. “If the work participation rate for this group went back to just 93 percent – the current average for the other developed nations – approximately 10 million more people would be working in the United States.”

Take a look …

(Click to view)

(Via JP Morgan Chase)

“Something is wrong – and it’s holding us back,” Dimon observed.

What’s wrong, though?

A lot.

To start with: Unrestrained deficit spending, crony capitalist trade deals, the perpetual incentivizing of dependency, wide open borders, incessant global warmongering, ill-conceived money-printing, socialized medicine and draconian overregulation.

And if you think the new GOP regime in Washington, D.C. is going to start picking those anti-competitive policies off one-by-one … think again.

Government – at all levels – has become increasingly debt-addled and dysfunctional.

American exceptionalism built on the premise of equality of opportunity has given way to government intervention built on the premise of equal outcomes.

Everybody knows it … and yet nobody has the courage to fix it.

Banner via iStock