GOOD NEWS, BAD NEWS …

A new report from the U.S. Energy Information Administration (EIA) found huge declines in proved reserves of oil and gas – although a big part of these reductions were attributable to plunging consumer prices.

According to the report (.pdf), “U.S. crude oil and lease condensate proved reserves decreased from 39.9 billion barrels to 35.2 billion barrels – a decrease of 4.7 billion barrels.”

That’s an 11.8 percent decline from year-end 2014 to year-end 2015, for those of you keeping score at home.

The report also determined that “proved reserves of U.S. total natural gas decreased by 64.5 trillion cubic feet” – from 388.8 trillion cubic feet in 2014 to 324.3 trillion cubic feet in 2015.

That’s a 16.6 percent reduction.

“Proved reserves are volumes of oil and natural gas that geological and engineering data demonstrate with reasonable certainty to be recoverable in future years from known reservoirs under existing economic and operating conditions,” the website OilPrice.com noted.

It’s that last line that matters …

With oil and gas prices plunging last year by 47 percent and 42 percent, respectively, numerous exploration plans were put on hold and existing reserves were dramatically downgraded.

Obviously we’ll continue to keep an eye on this data as the debate over Atlantic offshore drilling ramps up …

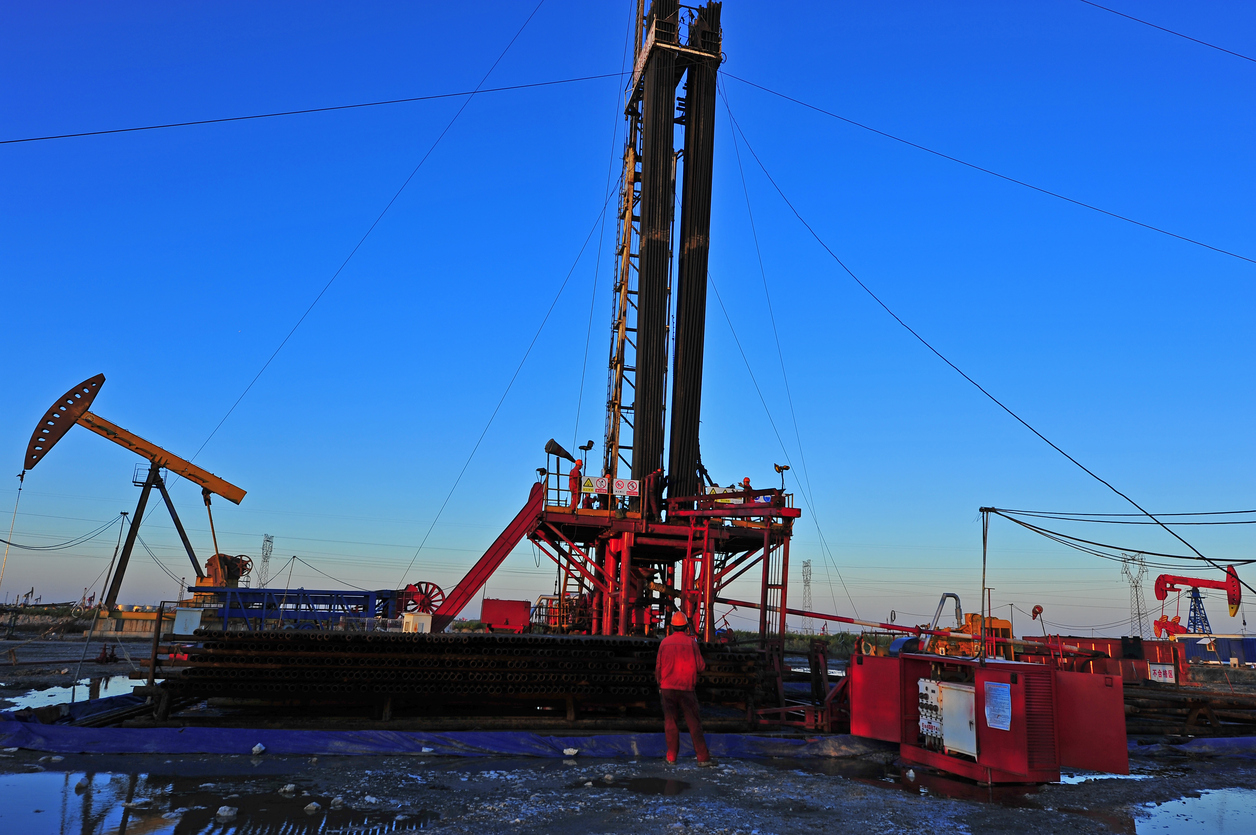

(Banner via iStock)