WEAKENING PERSONAL FINANCIAL OUTLOOK DRIVES DECLINE …

Bloomberg’s weekly Consumer Comfort Index (CCI) slipped to its lowest level in three months – driven by a sharp deterioration in Americans’ views of their personal finances.

The CCI stood at 41.8 – well below its yearly average of 43.4.

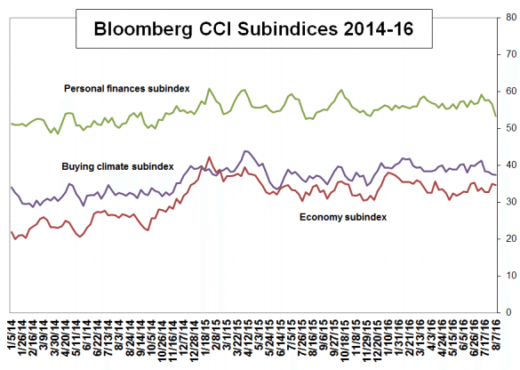

For those of you not hip to this metric, the CCI is based on three subindices: Americans’ ratings of the national economy, their personal finances and the buying climate.

The broader index – and it subindices – range from zero (bad) to 100 (good).

This week the personal finances subindex slid 3.1 points all the way down to 53.4.

“That’s its largest weekly decline in more than two years and the largest in any of the three CCI subindices since February 2015,” researchers noted.

Here’s a look at the recent trend lines for each of the three subindices …

(Click to enlarge)

(Graph via Bloomberg)

For those of you keeping score at home, the CCI has been compiled weekly since December 1985 by Langer Research Associates. The index’s record high of 69 was reached on January 16, 2000. Meanwhile its record low of 23 has been recorded on four separate occasions – most recently on June 21, 2009.

Our view on these numbers? Obviously they’re not good. Any decline in the personal financial subindex is especially troubling because it means the macroeconomic recessionary trends we’ve been tracking all year could be starting to hit home.

It’s one thing for consumers to gripe about the buying climate or the state of the national economy, but when they start feeling the pinch in their own pocketbooks … that’s not good.

Needless to say we’ll be keeping a close eye on this particular subindex in the weeks to come …