AMERICA’S ECONOMIC EXPANSION IS GRINDING TO A HALT

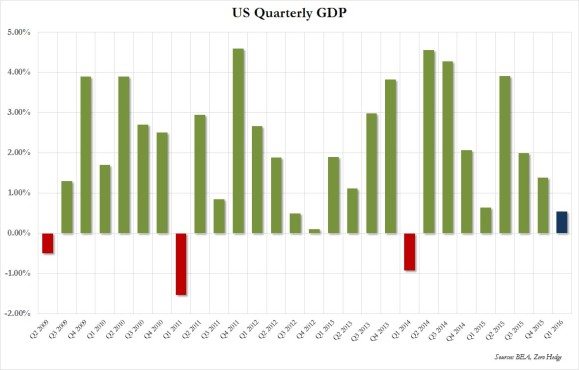

The United States economy expanded at its slowest quarterly rate in two years – posting a 0.5 percent growth rate during the months of January, February and March.

Analysts had expected a 0.7 percent “expansion.”

What they got was the worst quarterly performance since the first quarter of 2014, when the weather was blamed for a brief contraction in gross domestic product (GDP). They also got the third consecutive quarter of GDP declines.

According to the data (.pdf here) released by the U.S. Board of Economic Advisors (BEA), “the deceleration in real GDP in the first quarter reflected a larger decrease in nonresidential fixed investment, a deceleration in PCE, a downturn in federal government spending, an upturn in imports, and larger decreases in private inventory investment and in exports that were partly offset by an upturn in state and local government spending and an acceleration in residential fixed investment.”

PCE – or personal consumption expenditures – expanded at a 1.9 percent clip, the lowest uptick since the first quarter of 2015.

Here’s a look at the recent history of this critical measure courtesy of our friends at Zero Hedge …

(Click to enlarge)

(Graph via Zero Hedge)

The estimates released by the BEA this week represent “advance” data. A supposedly more complete measure will be released on May 27. In the meantime, two branches of the Federal Reserve bank publish regular updates on what they believe to be the “live” GDP of the U.S. economy.

For those of you keeping score at home, GDP growth – or the value of all the goods and services produced by a country – has been hard to come by in the era of obscenely big government. The American economy hasn’t grown at an annual rate of five percent since 1984, and hasn’t hit the four percent mark since 2000.

Hell, the economy hasn’t grown at even a three percent clip in eleven years.

By contrast, growth exceeded five percent in twelve out of thirty years from 1950-1980. And it exceeded four percent in seventeen out of those thirty years.

Bottom line? The perpetual expansion of the welfare state, unchecked crony capitalism, wide open borders, reckless global interventionism, rigged trade deals, manipulated currency, the imposition of socialized medicine (a.k.a. “Obamacare”) and unrestrained deficit spending are conspiring to destroy the American economy.

Our choice is simple: Reject politicians of both parties who embrace these things, or continue voting for them … in which case we should expect things to continue getting worse.