… BUT CONCERNS ABOUT NATIONAL ECONOMY ARE ON THE RISE

Rampant uncertainty about the health of the American economy has yet to manifest itself in reduced consumer comfort … or at least that’s the impression one would take from the latest data released by Bloomberg.

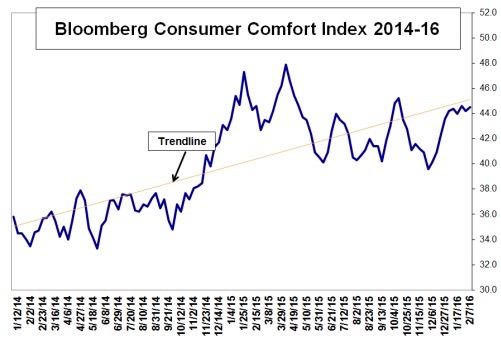

Bloomberg’s Consumer Comfort Index (CCI) -which measures consumer comfort on a scale of zero to 100 – is holding at 44.5 according to the latest measurements (.pdf here). The index has “regained nearly all of its 5.6- point loss from a late fall slump, but remains short of its recent high, 45.2 in early October, much less its post-recession peak of 47.9 early last April.”

Trend lines are “holding.”

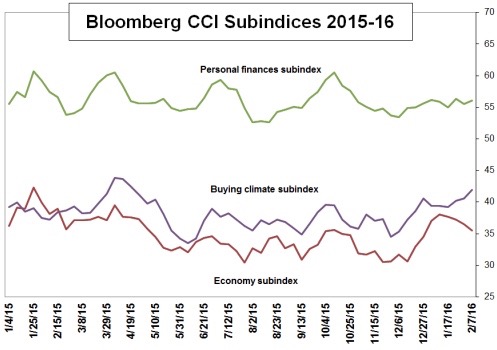

Meanwhile there are some interesting discrepancies in the CCI’s “subindices.”

Positive views about the current buying climate have obviously been offset to some degree by souring views on the national economy … which could mean this index is headed for a downturn in the near future.

Since December 1985, Bloomberg’s CCI has been compiled on a weekly basis by Langer and Associates. Its record high of 69 was reached on January 16, 2000. Meanwhile its record low of 23 has been recorded on four separate occasions – most recently on June 21, 2009.

RAPID REACTION >>>

@fitsnews Not anyone I know, everyone is cutting back

— beerman99 (@Flakeyman99) February 11, 2016

8 comments

Here’s the chart you need to see today: http://s9.postimg.org/nrseec8zj/gold_today.jpg

Gold is still in a slump compared to what it was around 5 years ago.

It’s now over $1,250.

You’re partially of course right, The peak was the Dec-10/Jan-11 spike where it got over $1,800. However, since that spike it never returned to the $400-$600 to $800-$1,000 ranges that are more common over the last 30 years

The Ten year chart: http://s10.postimg.org/4cihuhwrd/gold_10_year.jpg

Got to $1,260 and took a slide back to $1,255. Damn, I need it to go tot $1,300.

In spite of everything else in the news, today, weekly unemployment claims are at a seven week low, The number receiving benefits declined about 20,000 to a rate of 1.6%, down 0.1%.

http://www.dol.gov/opa/media/press/eta/ui/current.htm

The Sky – – – is falling. Sell you’re house, before it implodes……..

The Sky – – – is falling. Just ask FITS and ZeroHedge – they knowz……….

The Rain, is falling on our parade of hope,

I can’t afford the mil, Let alone the dope.

The Sky – – – is falling, the end is near…………

I just keep saying it……. lend me your ear!

Don’t forget the Economic Collapse blog! (Another FitsNews fave)

They certainly have no self-interest in putting a negative spin on the data with a name like that.

There once was a time a while back, in 1998

When everyone watched the DOW and resigned to a horrible fate,

The DOW was at 8900, and fell to 7000 by July.

All the investors paniced, all the families they did cry,

It started with a little Indonesian fear,

spread to Thailand, and Malysia – oh dear,

Then we are realized we were fine, the sun again did shine,

And the DOW hit 9800 be end of the year.