JUST … DEAD

What’s a “dead cat bounce?” It’s an economic term. Well, specifically it’s an investing term – referring to small, short-lived and unsustainable “recoveries” in the price of a stock.

Confused?

For those of you educated in one of South Carolina’s numerous failing government-run schools, it’s like this: When you throw a dead cat, it might bounce – once – but it’s not coming back to life.

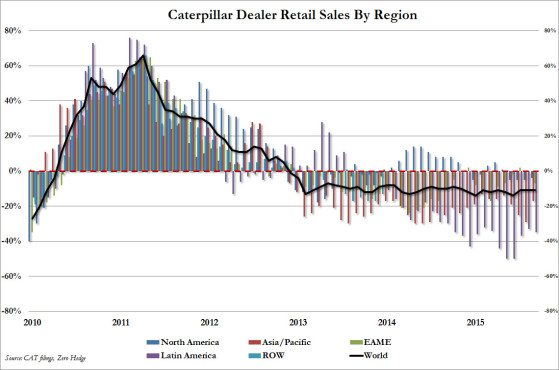

Which brings us to Caterpillar, the global industrial bellwether whose economists have consistently been one step ahead of the government bean-counters. According to the company’s latest monthly sales data, every single global region posted declines in September – the first time that’s happened in 2015.

But that’s not the scary statistic …

The scary statistic? Check out this graph from our friends at Zero Hedge …

(Click to enlarge)

(Via Zero Hedge)

Yeah, for those of you keeping score at home that’s thirty-four consecutive months of sales declines.

And yes, the impact of this ongoing decline has been felt in South Carolina. And will no doubt continue to be felt in the future …

9 comments

Notice the huge, huge spike after the stimulus? I guess them projects was Cat ready. Eh? And nice snapshot. Can we see a longer one that allows us to take into account rises and falls in business cycles over say a 30 year period? Of course we can’t – that wouldn’t fit in with the ZeroHead program.

??

More stimulus spending please…Mr. Chang…

I sell your treasuries fat American! I give you big red Chinese dick after years of taking red, white & blue dick!

Ha! You stupid Americans can’t see the tsunami of dollars coming back to shore while I use my proxy Belgium to buy gold.

F You Fat Americans! Fffffffff Youuuuuuu!

I promise Mr. CHANG, my grandkids can pay your grandkids back what I borrow…please!

Oil prices, low commodity prices (mining) and slowdown in China and economic upheaval in Brazil.

Yea, but I bet it’s also a cyclical business and this cycle is fairly constant over a 20 year period. And Brazil will bounce back, the reative strenght of the Real was never going to last. And most of their borrowing rates are inflation adjusted (i.e. your fixed rate mortage is actually the fixed rate plus inflation), so it will quickly dampen demand, then as part of a normal recession, rates will fall. And then it will pick up again. It’s not like their Russia – who is currently projected to run out of all foreign currency reserves in 14 months. Think about that – Russia is broke in 14 months. Can’t borrow, no cash. Totally dead.

South Carolina’s boat is rising more than most

Regional and State Employment and Unemployment (Monthly) News Release October 20, 2015

http://www.bls.gov/news.release/laus.htm

HIGHLIGHTS

The largest over-the-month percentage increases in employment occurred in Delaware and Kansas (+0.4 percent each), followed by South Carolina (+0.3 percent). Over the year, nonfarm employment increased in 46 states and the District of Columbia and decreased in 4 states. The largest over-the-year percentage increases occurred in Utah (+3.7 percent), South Carolina (+3.2 percent)..

In September, 11 states had statistically significant over-the-month unemployment rate declines, the largest of which occurred in Missouri, Rhode Island, and South Carolina (-0.3 percentage point each).

In September 2015, nine states had statistically significant over-the month changes in employment, six of which were negative. The largest significant job decreases occurred in Missouri (-16,500), Pennsylvania (-16,400), and Hawaii (-8,100). The significant job gains occurred in Texas (+26,600), South Carolina (+6,300), and Kansas (+4,900).

You believe EVERYTHING Obama and the media tells you about a RECOVERY..FITSNews jerks-off with glee, every time he’s fed “good” economic news by the Greedy-DC-Elite..

Yet, you attack other people for lack of education…Just because your parents failed you- along with your teachers at the bland subdivision schools- don’t try to put everybody else in your boat….we WARNED you about Obama…you choose to suck him off…don’t blame us for that.,…