The Global Currency War Is On

CHINA FIRES THE FIRST SALVO … || By FITSNEWS || China shocked the world this week, devaluing iYou must Subscribe or log in to read the rest of this content.

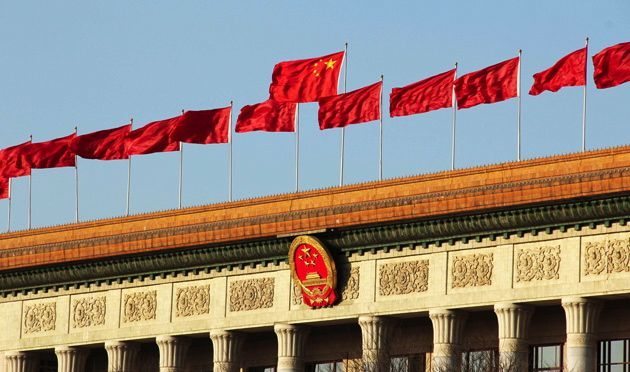

CHINA FIRES THE FIRST SALVO …

|| By FITSNEWS || China shocked the world this week, devaluing i

22 comments

When will people realize that currencies are non-existent? There is absolutely no value to currencies.

Only when our human masters say so. Until then good luck. The masters have spoken.

When one currency doesn’t translate to a better buy for what you want;your dollar,euro,pound,etc

It ain’t worth a thing but everyone still needs it.

Currency is a standard measure of value for goods and services. Without currency, how would you pay wages and salaries, and how would you express the value of milk, eggs, gasoline, and an Uber ride?

Many US businesses/exporters are doing poorly or have gone out of business after the USPS International shipping costs were raised by an insane increase.

That said,buying from Europe can be less expensive than buying American,right now.

US exports that will be hurt by a devalued Yuan are less important to the American economy than a strong stable US dollar, particularly when we count on China to loan us their money by buying our Govt. bonds. Cheaper imports help American consumers.

Only your masters. Money

The numbers are confusing, but this chart linked below with an inverted vertices axis is easy to read. When #Yuan/one dollar rate increases that means the Yuan has declined in value, thus the inverted axis. 6.2298 is the mid point of a fixed trading range. Since there is pressure on the Yuan/Renminbi, it’s actually trading at 6.33 which is lower on the chart.

http://mobile.nytimes.com/2015/08/12/upshot/why-did-china-devalue-its-currency-two-big-reasons.html?_r=0&referrer=

I would not be to critical of China. In the last three years the Yen, Euro and Pound have dropped over 20% from their 3 year highs. The Yuan has only dropped 5%.from it’s historical high. This is a blow to the Chinese effort to make the Yuan a reserve currency. The IMF just rejected the Yuan in their reserve currency basket. This is an indication of weakness in their economy and regulatory structure.

The US Dollar is the king of the heap. It has risen against other currencies, gold, oil and many other commodities.

Your bible shit is fucked up.

End of story

http://www.forbes.com/sites/bobmcteer/2015/01/24/is-a-strong-dollar-a-good-thing-or-a-bad-thing/

http://libertystreeteconomics.newyorkfed.org/2015/07/the-effect-of-the-strong-dollar-on-us-growth.html#.VcqRAflVhBc

http://www.msn.com/en-us/money/other/10-reasons-to-love-the-strong-dollar/ar-BBlDXNC

Gee – conflicting opinions.

Let’s break the tie with Faux news, shall we?

Lol….well done, sir.

Take Faux News and BSMBC and meet in the middle. Thus, you land on the (doesn’t exist) media outlet.

Hopefully, one day.

Hopefully, one day.

——

Be careful what you ask for – you might get it.

Indeed, I could only hope for a media that had no agenda.

It’s kind of like the snipe I was told to hunt long, long ago. I’d love to find that snipe and hang it in my non-existent trophy room.

a media that had no agenda.

——–

You said “meet in the middle” – :)

oops!

http://www.foxbusiness.com/investing/2015/08/11/china-joins-global-currency-wars-hitting-us-soil/

We are all in the same boat. If China’s and Europe’s economy suffers so does ours. The dollar’s relative strength means our economy and financial and political institutions are stronger, but it still has counter cyclical effects that hurt us. That’s why we want recovery in China and Europe. If the devaluation works then we will be better off, but other things China is doing to prop up its stocks is bad because it destroys the purpose of a market. Though the US and Europeans have done similar things with TARP, the markets still took a haircut and we’re allowed to decline. But damage to the principle of “Moral Hazard” was done.

Trump and the anti-trade goofs think they can protect US jobs. It would only be temporary relief. With only 320,000,000 citizens 4.5% of the world’s population, that is not enough customers to support the many large industries. Our industries would stagnate. In trade competition, the TPP opponents want the US to drag it’s feet and hang back at the back of the line. Volvo and BMW understand to importance of manufacturing on several continents, but in the US we call it off shoring or exporting jobs. BMW is stronger than Ford or GM and German jobs are safer than jobs at Ford or GM, even though they are becoming more International.

This shit is too easy. Blow China of the map.

One-off? MY FOOT! THE CHINESE JUST LOWERED IT AGAIN.

“On Wednesday, China’s central bank fixed the “official midpoint” for the yuan down 1.6% to 6.3306 against the dollar.”