OVERWHELMINGLY …

|| By FITSNEWS || South Carolina’s “Republican-controlled” House of Representatives chose to celebrate tax day by passing a $427 million gas tax and vehicle sales tax hike – one it claims will be “offset” by a modest $50 million income tax cut.

Wait … offset?

How’s that for South Carolina math?

Any of this sound “conservative” to you? Of course not … but we’ve been beating that drum for months on this issue. As we noted last month, “raising taxes and throwing more money at problems is the South Carolina way … for our roads, our schools, our prosperity, our health, our safety.”

How’s that strategy working out? Well, our roads and schools are abysmal (click here and here), our state is poor and unhealthy (click here and here) and when it comes to crime … well (click here).

We’re not saying infrastructure isn’t a core function of government: It is. We’re saying the following …

1) South Carolina’s network of state maintained roads (the fourth largest in the nation) is far too big.

2) South Carolina’s method of funding transportation projects is corrupt and inefficient (as we’ve documented repeatedly).

3) South Carolina’s government spends billions of dollars on non-core functions … yet claims it must raise taxes for core functions.

Seriously – the same House members who voted for this tax hike have approved billions of dollars in new spending on South Carolina’s worst-in-the-nation government-run school system, its duplicative and inefficient higher education system, bailouts for wealthy corporations, shady ‘economic development‘ deals and … lest we forget … dozens of exorbitantly expensive and totally unnecessary highway projects.

They have the money to fix our roads and bridges without raising taxes … they are simply choosing not to do so.

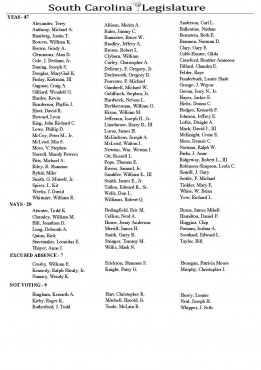

In fact they are choosing not to do so by a whopping 87-20 margin … with the vast majority of “Republicans” voting for the tax hike.

Here’s the roll call for those of you interested in how your lawmaker voted …

(Click to enlarge)

(Pic: Via S.C. Statehouse)

Making matters worse? The “Republican-controlled” S.C. Senate is even more liberal than the House – and will likely approve an even bigger gas tax hike.

S.C. governor Nikki Haley – who proposed a gas tax-income tax swap earlier this year – ripped the House proposal.

“Your Republican House just voted to raise your taxes by $365 million next year,” she wrote on her Facebook page.

Haley has pledged to veto any tax hike passed by the legislature, but she’s been anemic with her veto pen in the past – and given the overwhelming support this proposal is receiving in the legislature her opposition may not matter. Lawmakers clearly have a two-thirds majority to override Haley in the House – and we’ll know soon whether they have a similar super-majority in the Senate.

Bottom line for dirt poor South Carolina motorists (who already spend more of their incomes on fuel than any state save Mississippi and West Virginia)?

Bend over …

39 comments

Hey, at least they’ll repave our road to nowhere and highway to hell.

Overwhelmingly passed by Republicans, but you still call them “Republicans”? When are you going to admit that this is actually what the Republican party stands for in this state and throw away the cliche quote marks?

Republicans my ASS!!!!!!!!!!!!!!!!!!!!!!!!!!!!

Democrats in Republican suits!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

I just love the ‘do no wrong’ logic of the Republican party. They have complete control of the state, but all of its woes come down to the times when they ‘act’ like Democrats.

The Republicans are the “New Democrats”!

The Democrats are the “New Socialists”!

Again, that falls perfectly into the Repub logic. They cut taxes for the wealthy then cry to holy hell when poor ask for anything, crying Socialism. And the sheep addicted to Faux News suck it all in gleefully.

Who couldn’t see this coming? Handing more money to an agency that can’t account for the money it gets….perfect analogy for government efficiency aside from the corruption implications.

let’s see now, A supposed Republican Government in SC:

Constant Ethics violations

Constant increase in spending and Govt. growth

Constant incidences of moral turpitude

Constant hiring of female companions at outrageous salaries

Constant self serving benefits to themselves, salary increases and benefits

Constant violations of the law

Constant use of taxpayer funded junkets

Constant use of taxpayer funded taxi service

Constant incidence of hidden fees and tax increases

Republicans? Conservative? Watch dog for taxpayers? Transparency? High morals?

Ethical behavior?

None of the Above!!!!

I can’t see the list of votes well enough to read it. It is blurred on my Droid.

Ok, I finally “clicked to enlarge”. I thought it was for a porn link to make my penis bigger.

Start with throwing bags of dog shit in their driveways and on their automobiles. Then move up to tossing water in their faces when they are out in public places.

Why limit it to dog crap? What about cat poop? That smells worse over time.

Got not-so-fresh tomatoes? How about a milk shake bazooka?

Gotta love that new car sales tax. Guess Florence and Charleston will get the shaft again. If you live in Columbia or Spartanburg you’ll go to NC to buy your cars. If you live in Aiken – you’ll go to Augusta. Hilton Head – you’ll go past Beaufort and head to Savannah. Thanks guys!

Does NC not charge a sales tax on Autos?

Last time I checked Florence was closer to NC than Columbia.

But there’s nothing really nort of Florence – except I guess Lumberton.

You pay the tax when you register the car in SC, matters not where you buy it

Best new car deals with low taxes online: eBay or Craig’s List … One can even find very low milage “used” like new.

The good thing is Nikki gets a lesson in ‘I’m not that important after all’.

Is not*. True, the state will have to maintain our roads for a long time from now, simply because it has been. But it still needs to begin the process of getting the state out of this business. This is a subsidy to people who want to work in the city and live in the “country” (read suburbs), distribution companies, and people who ride bicycles in the publicly funded gym called state maintained asphalt. It is also a tax to people who try to live simply; by living close to work, or just not driving a car all the time.

Maintaining rights of way is a core function of government, not 6 inches of asphalt. Try toll roads based on weight, if you are on a bike or walking it is free if you stay on the grass or a quarter to go on a paved surface. If you want to read more about why this is BS try theamericanconservative.com under the New Urbanism section. Might be a good place to start.

“1) South Carolina’s network of state maintained roads (the fourth largest in the nation) is far too big.”

And, dumbass, how much do you think it would cost to dig ’em up and haul off the asphalt?

How about just leaving those “extra” state roads alone or turning them over to the counties to repair … or not.

Folks always trumpets the 4th largest state road statistic, but that does not tell the story. What matters is our total state and locally maintained paved roads, which is probably not nearly as sexy a statistic. Most states have much more of this task allocated to county and city government, but it is total paved surface area that matters. Where does SC rank in that statistic?

Gas tax is one of the few ways we can pass a portion of the cost along to out-of-state pass through traffic.

My question is, why are we spending billions in Mt. Pleasant but leaving our interstates to turn into gravel roads? I am on my 3rd windshield in 2 years.

This has been pointed out to him several times, yet FITS keeps repeating it. Never let the facts get in the way of a anti-government narrative.

The fact is that the SCDOT can’t provide a detailed audit of its finances. So don’t let that fact get in the way of your pro government narrative.

1) Do the state roads really need that much repair. (Got numbers? # Miles of road to repair? # Bridges needing rebuilding? … estimates of bottom line for these repairs?)

2) Are there other state budget items that could be cut or used for the purpose?

3) Are the estimates for “road repair” actually allowed for open bidding? Furinstance, could a private contractor bid three bridge repairs as a group? Could an outside agent pay? (Has South Carolina g’ment ever gotten refunds for Harry Reid’s fiasco in the Nevada desert? Don’t the Feds have money to repair the federal highways and Interstates? Is South Carolina getting its fair share of fed gas tax revenues?)

Lastly: 4) Where IS that money going? Is this new revenue going to pad out some pensions? Is it going to some “general account” where other “short falls” are satisfied? Is it Specifically for road and bridge construction and repair?

If any of these questions can not be answered To The Complete Satisfaction Of The Voters And Taxpayers, then those republicrats and their democrat ally taxsuckers should be jailed, run out of the state on rails or taken out ‘hind the wood shed with a baseball bat.

Nobody seems to give a care about those questions Eddy. At least not on this page? All great questions for someone who truly wants to look at the issue. Not good questions if you blindly follow government, or party.

Mmmm … But … but …

Shouldn’t the SC-DOT at least put up a web page with the numbers and/or where those g’ment revenue dollars are going?

I believe there was something online about this, but it has since been taken down. … http://www.scdot.org/resources.aspx just does not make it …

They have a page, just isn’t that easy to find and drilling down to get the numbers? Well….http://www.scdot.org/inside/revenues.aspx

http://www.scdot.org/inside/images/pieChart_BudgetRevenues.gif …

Quite interesting.

Now, how about the spending side? Got any good links there?

[My favorite food group: pie.]

It’s at the bottom of link, though good luck in figuring out what exactly these expenditures are:

Fiscal Year 2014-2015 Estimated Expenditures (In Millions)

General Administration $41.7

Engineering Administration $85.1

Intermodal Planning $26.4

Federal Program $989.8

State Maintenance $294.1

Tolls $7.5

Fringe $81.1

Port Access $52.5

Act 98 – SIB Projects $50.0

—————

Total Fiscal 2015 Budgeted Expenditures $1,628.2

Intermodal planning is just Central Planning newspeak/est-hole talk for trains, busses and airplanes = not taxpayers’ cars and trucks.

What the hoohaa is “Federal Program”? Is that revenue income or revenue spending or fed “matching” of fed mandated stuff?

I see what you mean about these mysterious categories like “State Maintenance”, “Fringe”, “SIB Projects” … Can’t tell if those Central Planning taxsuckers are coming or going or slipping out the back door with your money.

Exactly! What is the Federal Program? It is listed under expenditures, which implies spending. I would guess it is obligations tied to Federal Income?

Would be interesting to see this broken down into much more detail.

Probably too many skeletons in those closets.

Does the state post any online charts of state spending … My favorite food: pie.

But the real deal in the 21st Century would be a g’ment spread sheet that truly itemizes … searchable, sortable … :<}

If they can create this by high level categories, they already have the data, exporting it into searchable/sortable spreadsheets should not be that difficult. My guess is – that would bring too many questions.

Ford or Mazda?

There are thousands of SC rednecks with 4 wheel drive trucks wanting to pound them in the face right now. And that’s a good thing :-)

Just wait until the state dumps all those miles of secondary roads onto the county taxpayers.Then just the county taxpayers will be responsible for rebuilding those roads. Estimated costs to Spartanburg County taxpayers for the estimated 452 miles of state secondary roads that are so bad that they have to be rebuilt from the road bed up, 100 million dollars plus and the State is just offering 1 million dollars toward that repair bill. About 20,000 miles of state roads are currently in the fair or poor category now. Every time it rains, snows or ices they just get worse. They are not going to fix themselves.

Typical SC Republican tax plan — cut a progressive tax and implement a regressive one.