MORE “NEW NORMAL” NEWS …

Days after a stunning decline in new home sales was reported, existing home sales also took it on the chin – declining 1.1 percent from the previous month. That’s the biggest miss so far in 2014 – and a sign the so-called “housing recovery” is continuing to limp along in fits and starts.

The good news? The median home price is up 4.3 percent year-to-year … although unfortunately that’s the slowest rate of growth since March 2012.

The National Association of Realtors (NAR) predicts existing home sales will decline from 5.1 million in 2012 to 4.9 million this year.

The NAR’s chief economist Lawrence Yun – a South Carolina native – said a combination of supply shortages, flat wages and tight credit were “deterring a higher number of potential buyers from fully taking advantage of lower interest rates.”

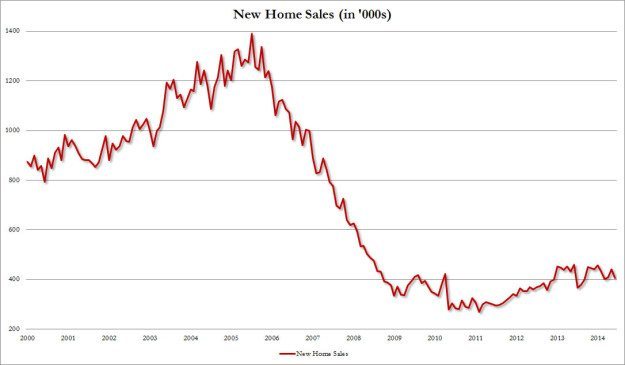

Last week new home sales data was released – showing a 20 percent month-to-month drop (from 504,000 to 406,000 units). Of course data from May, April and March was revised downward (by a total of nearly 80,000 units).

Wanna see what that looks like?

(Click to enlarge)

Yikes …

And there you have yet another illustration of the “New Normal” (a.k.a. what happens when chronic government intervention suppresses private sector growth).

11 comments

And the big, bad wolf said to the little pig who had build the house of straw, “I’ll huff, and I’ll puff, and my economic headwinds will blow your house in.”

Please note when referring to the above graph, that for ease of reference there is a shorthand description for that giant downhill slope in the middle of the graph; “Bush Administration”.

Please note that Tom likes to entirely ignore that the nation’s banking industry–including all mortgage backed securities–conveniently brought down the whole artificially inflated real estate market. This was done by “Wall Street.” The Big Short by Michael Lewis is a very interesting read, if you’d like to see more about how this all happened.

Tom, applying your logic….and taking your implication, is it Obama’s fault that Hurricane Sandy destroyed New York / New Jersey? I’m absolutely no fan of Bush. I vehemently despise the policies of almost all politicians, including Bush. But what cannot be overlooked by your silly attempt at placing scapegoat blame with a short “one liner” is this…….. the very belief system of saying “XXXXX Administration” must explain a failure completely forgets individual and personal accountability. Sure, Bush was in office when the sub-prime mortgage market hit its peak. But every single Tom, Dick, and Harry mortgage broker that enticed everyone of those “No Doc” loans and raked in huge commissions didn’t seem to mind.

It all starts with you

So now that the Blowfish have signed a deal to move to Lexington where a new stadium will be built for them, who will be be playing at the baseball stadium T-Bone is building on Nuthouse Row? This area is not large enough to be the home to two minor league teams. Maybe they can rent it out tho Eau Claire High School.

how long is the deal for? Is this the team that was supposed to be playing at the new Bob Hughs /T-Bone Stadium? Could this be a short deal until the stadium is complete?

If Lexington is building a three million dollar stadium I doubt it’s a short-term deal.

What I find most interesting is that the Fed is keying up to raise rates while sales are declining. Surely a death knell.

“And there you have yet another illustration of the “New Normal” (a.k.a. what happens when chronic government intervention suppresses private sector growth).

Funny how profits increased while employee wages remained flat (not counting big management bonuses). I’d buy a house in a minute, except that my wages haven’t increased in almost a decade while my buying power has lessened considerably. If my wages had increased even as much as cost of living, I could probably afford a house. Nothing fancy. BUT the bidnessmens gotta get their big bonuses and pay dividends!

Frankly, I can’t wait for the still-artificially-inflated home values to crash and burn (which they will). I’ll need a place back in the USA in about five years so get to it.

Weird…the CHS market is as hot as its been in years. C’mon Ohio-ans..keep buying!! Daddy has a house to sell in Mt P!

It’s like San Fran, LA, etc.

Location, desirability, etc….all those locales get buoyed by the money printing till the party is over.

I’d sell now while the getting is good(both real estate and stocks), it’s hard to see all time high’s in the stock market lasting much longer…and interest rates are still low.

There’s not a lot of reason to buy a house in Columbia….regardless of what the market is doing.