HERE’S THE RESULT OF ALL THAT “STIMULUS”

It’s no secret the federal government’s blitzkrieg of bailouts, stimuli, money-printing and deficit spending in response to the recent/ ongoing recession has not benefited the American people.

Or improved the economy …

Instead, Washington, D.C.’s economic interventionism has made things much worse for those of us subsidizing all this command economic nonsense (and especially worse for our children). Crony capitalism hasn’t been bad for everybody, though. In fact the last five years have been a boon for Wall Street – which has seen explosive growth.

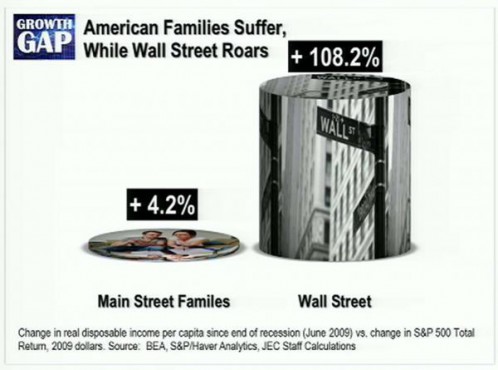

The old argument was always that this was a good thing … rising tides lifting all boats and such … but as the chart below (presented by U.S. Rep. Kevin Brady to Federal Reserve chairman Janet Yellen) demonstrates, that’s no longer true.

While Wall Street is booming thanks to government handouts and artificially created liquidity, the normal families paying for all that are continuing to struggle …

(Click to enlarge)

Yeah … ouch.

“The only people doing well in this recovery are those who have benefited from the Federal Reserve’s continued monetary morphine that has juiced profits on Wall Street, while family incomes have stagnated,” Brady said last week in a statement.

We concur … and more importantly, so do the numbers.

25 comments

what the frack?? comparing income growth to the S&P 500?? what the hell is this ‘graph’ supposed to mean? the S&P isn’t somebody’s income. this is nowhere near apples and oranges. more like apples and staplers.

If you have done any reading lately, you may have noticed that there has been much made in comparing “returns” on capital vs. returns on labor. Income growth for labor and growth in a capital “investment” (via the S+P return) is a good proxy for that discussion. The theory is that income inequality in this country (and the world at large) is being driven by outsized growth of capital versus gains by labor since typically only the wealthy have capital to invest.

“If you have done any reading lately”

bad assumption dude….

since typically only the wealthy have capital to invest.

——–

the vaunted “job creators.”:

Too bad Ayn Rand isn’t here to write a novel that proves the S&P 500 is a person.

i-wind, agreed, when the stock market fell to 6000 (DJI) did income FALL by 50%

You all have more or less nailed my point. The vaunted “job creators” are more often than not just rentiers in disguise. The people who really add value to the economy are the “makers”. Whether it is manufacturing or the so called “knowledge” economy, the people making the widgets are the creators of wealth. The problem is that the way we value labor as opposed to the value we place on people who direct the flow of capital investments is waaaaay out of whack. Does a CEO really ad value 200x the lowest paid full time employee in his or her company? Probably not.

The stock market and state of almost across the board asset bubbles helps many of these CEO’s justify their short term “stupid pay”.

If the market(s) were healthy/competitive there’s no way CEO’s would be getting the pay factors they do.(and I’m talking about public corps, you don’t see that shit hardly at all in private corps)

Oops!

My bad dog. I thought the printing up money thing would end differently this time.

Do over?

And that is why Sic Willies prescription for all this is to cut taxes for,well, the people on Wall Syreet,plus he will even throw in a little for the working folks,about enough for you to take the family out for the Tuesday night special at Burger King.

And if you point this all out,his response?Well, we got to be “fair” to the wealthy.You expect the Kochs to live off 100 Billion?Damn what kind of Commie are you?

AZT didn’t cure AIDS, but they’d die without it.

Just for you Max

BENGHAZI!!!!!

MORE! MORE!

we love Benghazi, more plese, please include Obama care.

You know what?

Chicken butt.

QE didn’t cure the economy, but it would have been much worse without it.

I blame Bush………………..

LMAO!

Do you mean the rich people wouldn’t have been as rich if there wasn’t QE? Yeah….I suppose that would have been “much worse”.

payroll wouldn’t have been met in more companies than you can count – in fact, *every* 3/90/120 day line of credit would cease to be extended in every part of the country, bringing commerce to a hard-lock stop.

But the rich wouldn’t get their cut – you’re right about that.

Man, you bought the gloom & doom scenario painted by bureaucrats in DC, you are way too trusting.

This was for euwe max, I have no idea how “guest” with no remarks popped up.

some QE was necessary, without it the economy would of collapsed into a depression.

Raise the capital gains tax.

this actually did start with the Big-O, am I the only one who remembers the “jobless” recovery. this economy has been in a “jobless” boom!

“this actually did start with the Big-O”

This shit transcends more than 1 President, the nation has been running deficits since 71′ and using money printing as the short “fix”, exacerbating the business cycle with each cycle, and getting worse and worse each cycle.

The black Jesus isn’t the only guilty party, you start with Nixon and blame every President & Congress since then.

Certainly not, but he’s added more to the debt than any other prior president combined has.