We learned last month that you can’t stop the federal government … nor can you (in the words of the sports cliché) “hope to contain it.”

Even during the so-called “shutdown,” 83 percent of the federal government kept humming along like nothing happened.

Because nothing did happen.

Anyway, this week the U.S. Treasury – which views any interruption of any government expenditure as an apocalyptic event – released its FY 2013 outlays. For those of you educated in South Carolina government-run schools, that means it told us what it spends our money on.

Why release this info now? Because the federal government’s fiscal year ends each year on September 30 … not December 31.

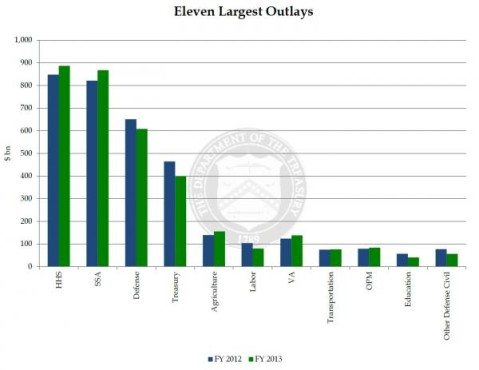

At just under $900 billion annually, the top item on the list was spending on Medicaid and Medicare – which was up from roughly $830 billion last year. Next up was the roughly $860 billion spent on Social Security payments – also up around $50 billion from last year. Defense spending came in third at just over $600 billion – down from around $640 billion the previous year.

The fourth largest spending category? Interest payments on our mushrooming national debt – which stood at $400 billion. That’s down from roughly $460 billion a year ago, but still more than 10 percent of the total federal budget.

Which is totally unacceptable …

Also unacceptable? Another $680 billion in deficit spending was approved during FY 2013 … on top of the $5 trillion in new debt accumulated through the first four years of the Obama administration.

Courtesy of the U.S. Treasury (via Zero Hedge), here’s a chart which shows the raw data from 2013 and 2012.

(Click to enlarge)

16 comments

We have way too much government spending, comrades.

I think you forgot to include one major spending program: PBS. It’s got to be one of the largest spending items given how much Republicans complain about its cost.

I also like the fact that the chart has 2 categories of “Defense.” There’s “Defense” then “other defense civil.” Kind makes me think it’s goal was to make it look like we’re not spending as much on defense than we actually are.

“The fourth largest spending category? Interest payments on our mushrooming national debt – which stood at $400 billion. ”

The Keynesian crowd better hope they can keep a lid on interest rates….FOREVER!

If they go back to 6%, just the interest payment alone will immediately bankrupt the country. (instead of debt accumulation)

Of course, they can always pull a Zimbabwe and simply print up the payments, I’m sure that won’t cause rising prices or anything. It worked out well for Weimar Germany too.

lol

Runaway inflation would be good for anyone who currently has debt. Imagine getting paid $100,000 a day for work. Sure, it’d buy you an apple or whatever, but you could pay off your house with 3 apples. Better borrow while the borrowing is good. And whatever you do, do not borrow money once the runaway inflation has begun.

Ahh…but the assumption is your salary would track runaway inflation…there’s not one example of that in written history.

It’s why German’s burned money in wheel barrel’s to keep warm towards the end.

Agreed though, it wipes out lenders….if there’s no government intervention.

Rest assured there would be. You can look fairly recently to Argentina as an example(I specifically researched this), the government actually adjusted people mortgages UPWARD to reflect money devaluation…pols egged on/paid off by their big banks to pass a law doing so…LMAO!

There will be no escape for anyone if it comes to pass in that manner.

We pay for Social Security and Medicare out of payroll taxes. Imagine if there were a payroll tax for defense and national debt interest payments? People know what they get from SS and Medicare, good luck explaining how hundreds of billions in defense spending and ever-increasing interest payments are worth paying for though.

I’m retired from the navy. One of the jobs I had was running an R&D program. People would gag if they knew how much waste and bloat there is in the DoD budget. I would guess we could cut about 20% off the top and redirect the remainder into equipment, training and general readiness AND not damage the genuine national security interests of the United States one bit. Too much of the defense budget is a public trough at which contractors feed. It’s a trough directly linked to the corruption and cronyism that pervades Congress. I know. I’ve seen it first hand.

Here, here…..and I would say 40% cut…you were being generous Manray…..

I’m giving them the benefit of the doubt.

What’s the matter? Didn’t Zero Hedge think the big picture was relevant?

Fiscal Year- – – – – – – – – – – – – – – – – 2009 2010 2011 2012 2013

Total Federal Spending ($Bn) 3,517.7 3,457.1 3,603.1 3,537.1 3,454.3

Federal Budget Deficit 1,412.7 1,294.4 1,299.6 1,087.0 680.3

Sorry about the crappy-looking table, but you can see that total Federal government spending in FY2013 was the lowest of the Obama administration, and the deficit has diminished every year but FY2011.

Fiscal Year: Total Federal Spending / Federal Budget Deficit

FY2009: 3,517.7 / 1,412.7

FY2010: 3,457.1 / 1,294.4

FY2011: 3,603.1 / 1,299.6

FY2012: 3,537.1 / 1,087

FY2013: 3,454.3 / 680.3

Of course, spending isn’t really decreasing by much. Would be nice if we let more of the Bush tax cuts expire and actually cut back spending some so that the deficit would have been further crushed, or even wiped out. Good luck getting any new revenue with Republicans around, though.

They cut food stamps recently. I’m sure that’ll fix everything!

You do know that Obama fought the Sequester spending cuts with everything he could right? I’m pretty sure he said the entire economy was going to collapse and we’d be living in a post-apocalyptic hellscape if we cut 2% of the federal government spending across the board.

And yet you give him credit for a policy that he opposed and did not endorse. Delusion strikes both sides of the aisle.

Yea the deficit is shrinking at a record pace, hell there almost wouldn’t even be a deficit if it wasn’t for the Bush tax cuts that for some reason Obama kept (well 98% of at least)

Debt as a percentage of GDP is not at record levels. Per Capita Debt is not at record levels. Taxes are at near post WWII record lows.

If it were not for our two wars, debt as a percentage of GDP would be near the post depression average. If the great recession had not occurred, debt as a percentage of GDP would be below post depression average. If we could have avoided the wars, the Bush Tax Cuts and the great recession, we would have been paying down our debt for the past 15 years.

Our debt is manageable. We need to make more cuts in spending over time, and we need to increase taxes.

Oh, and one thing we sure as heck don’t need to do is give away more money to SC’s worst in the nation private schools.

Jan, without going into a long explanation, do you realize that the GDP equation includes a “G”, which stands for government spending?

Why this is important is two fold, especially in light of your WW2 reference to the debt to GDP ratio.

1. The US at the time of post WW2 was under the “Bretton Woods” system. Basically, it means they could not create money up as easily(it’s a little more complicated than that, but this should suffice).

2. The “G” I referenced above is on the surface easily understood, government spends money…and it’s added to the GDP calculation.

Here’s the problem. When government creates money(instead of using taxpayer dollars) and then buys stuff, THAT GOES INTO GDP.

So think about this for a moment, you could have an economy going BACKWARDS…but in GDP as its calculated the creation of money out of thin air would suggest it is going forward. You can actually bamboozle people into thinking there is economic growth, or even maintenance , simply by creating money and having gov’t buy stuff with it.

Do you see the fraud? No worries if you don’t, you will eventually.

So when you see an article like this:

http://www.washingtontimes.com/news/2012/dec/7/government-borrows-46-cents-every-dollar-it-spends/

You should realize that the “G” portion of the equation has been overstated substantially, year over year, COMPOUNDED.

When you view the debt to GDP ratio through that lens, you realize the ongoing fraud that is being perpetrated.

There are a lot of bamboozled people when it come to the National Debt. A simple equation, my money doesn’t go as far as it use too but lately the government has plenty to spend.