South Carolina’s pension fund is one of America’s worst managed … and most corrupt.

As of June 30, 2013 – the end of the most recent reporting period – the fund ranked in the bottom 25 percent of all large pension funds (this despite paying the highest fees of any fund in the nation).

Of course its leaders are making bank … knowing full well there’s no accountability in state government. For anything.

In light of its mismanagement and corruption, why are this fund’s top executives receiving massive bonuses with public money? That’s a good question … one S.C. Gov. Nikki Haley (RINO-Lexington) and S.C. Senate finance committee chairman Hugh Leatherman (RINO-Florence) should be prepared to answer.

Haley and Leatherman’s appointees both voted to approve massive “performance incentive commission” (PIC) bonuses – which were first reported by FITS last week.

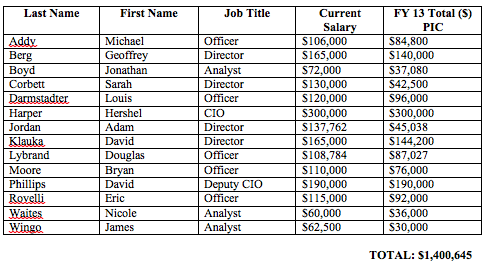

All told, fourteen staffers at the S.C. Retirement System Investment Commission (SCRSIC) received $1.4 million in bonus pay – although $490,000 of that total went to the agency’s two top employees, commission CIO Hershel Harper and deputy CIO David Phillips.

Take a look at the bonuses (then compare them to the annual salary of each employee) …

Yeah … that’s in a state where median family income is hovering just above $43,000 (and falling).

Since his election three years ago, S.C. Treasurer Curtis Loftis has been dutifully exposing the corruption and mismanagement of this $25 billion fund – which is run by one Reynolds Williams, Leatherman’s appointee.

Specifically, Loftis has been exposing how commissioners and their staff have been receiving all sorts of undisclosed perks from the firms they are doing business with – and in some cases profiting directly from deals.

What has Loftis gotten for his efforts? A literally non-stop vendetta … one fueled by the Palmetto State’s “bought and paid for” mainstream media. Not only that earlier this year Haley’s appointee to the commission sponsored a resolution to censure Loftis …

Frankly, we think somebody should give Loftis a medal for holding these goons accountable …

45 comments

Dayum, $300,000?

Hmmmm – wondering how much $$$$ gets donated to the Governess?

This just can’t be correct. I mean, this places them in the top 1 or 2% of earners in South Carolina and they are state workers.

God, I just hope Michael gets custody of the kids.

Adam Jordan and Sarah Corbett went from the $40k range to the $130k range. That’s over a 200% increase. Holy Shiite!

I worked with Adam Jordan at Commerce two and a half years ago. He made about 75,000 and was not a top performer.

Now he is making $ 182,000!!!!!! $107,000 raise in two years!!

Crap, how do I get a state job at this place?

Think you have the wrong guy. I worked with Adam at Commerce — bright guy who made much more than $75,000.

Nope…while he might have made 80 I can tell you it was close to 75.

I liked Adam…but his performance was mediocre.

Once I had a pension

Haley became Governor

Now I have a pittance

Cockroaches have my pension

Alex Thornton Write in Candidate for Governor

Is this the group that just awarded Willoughby & Hoefer Law Firm, $7 Million dollars in legal fees? John Hoefer, Jean Hoefer Toal’s first cousin? Reynolds Williams – who owes his law license to his inside connections with Jean Toal? Leatherman’s asshole buddy? Leatherman who is trying to make sure Toal is re-elected? I’m sure all of this is just a coincidence. Yeah. Nothing here….. Right. Same old, same old.

No! It was Loftis who gave the attorneys $9 million. BTW, I hope you Bozos know Loftis was on the Committee that developed this pay plan.

Loftis’ frat brother, Michael Montgomery, received a nice $2 million handout from the state, so we shouldn’t get too far ahead of ourselves. That just dorsn’t smell right.

Who gives a rats ass what it smell like. A a lawyer I can tell you when the defendant pays the legal,bill,it is agreed upon and a closed issue. You don’t Ike it, call the defendant.

I hope you don’t specialize in drafting wills or deeds or laws.

Those are first class attorneys. The fees are always approved by a judge and all parties involved.

Quit bitching, fees have been paid like this forever. Don’t like it, change the law.

But sounds like jealousy to me. Bad lawyers wishing they could play in the “bigs.”

Study harder. Win a few cases and maybe you can get out of the slip and fall class and into a more respectable and rewarding practice.

“Those are first class attorneys.”

Also known as “second class citizens”.

:)

I am very food at my job. I am among the best in the state but I don’t make that kind of jack even though I am invested in the company.

These clowns do not have skin in the game. They are state employees and their bonuses can run 10 to 20 thousand a month??!!

Haley needs to make this go away and before the election or I will not vote for her.

The Haley administration will never move to remedy this scandal. Too many contributions.

Vincent Sheheen has the perfect opportunity to stand up for the working class Retirees. It will be interesting to see if he has the guts to do so.

Haley will never do that. Investment Commission equals rich people. Rich people equal donations. She will always side with rich people that give donations.

The interesting thing about this is that none of this staff actually manages a dime of investments. They oversee external money managers that perform the investments. Go back to the late 1990’s and you will see that there were two true investment managers making the investment decisions for the Retirement System and all other state funds for a total of $26billion and neither were making $100k and no bonuses. The current group is completely out of control.

Were those the same investment managers who lost tons of money during the dot com bubble and even more by investing in Enron.

Poor poor me. I thought private enterprise was the way to make money. Who knew state employees earn this kind of jack.

My friend that works for the state said david Philips gat a $ 60,000 the day after the bonuses.

I call BS on that crap. Total BS

Fuck these people. They should be swinging from lamp posts while gutted Hannibal Lecter style.

Amen. Loftis for Governor.

The average state employee makes less than 50 grand a year. These clowns make 3,4 as much as 6 times this per year.

This is offensive and should be stopped.

Corruption. Pure and simple.

People that are paid that much more than they are worth are sure to keep quiet. Like the mob overpaying hit men.

Corruption.

The only goon on the Investment commission is Loftis. He is nothing more than a narcissistic Don Quiote tilting at imaginary windmills and imagining himself as the defender of all that is noble and virtuous. You can’t have a conversation with him without home regaling you with his self importance. If you disagree with him you are dishonorable and full of evil. Word on the street is that he started Nixon during his darkest hour. Most of the staff in Treasurer’s office would leave tomorrowif they had a chance.

I work at the Treasurer’s office and I like it there. The Treasurer is friendly and helpful and is engaged and works harder than any Treasurer I have ever seen. I do not know much about the Investment commission but he does ask a lot of questions and the lazy and the uninformed get angry and the diligent and informed answer the questions and do their jobs. My department has more tools and skills than ever before and that makes me feel good about my government service.

I love the Treasurer. I don’t work for him but follow him closely as I am a state employee and I am interested in my retirement. Please Mr. Treasurer, keep the Commission honest. I need my retirement!

If you think those no-risk, high-reward, donut-eating state bureaucrats are overpaid and worthless, read about the worthlessness of pension consultants generally, as Andrew Sorkin points out in his NY Times article today (below).

This reminds me of the many, many overpaid morons at the wheels of the Medical University of South Carolina, the College of Charleston, and the S.C. State Ports Authority, none of whom would make it in “the real world.”

— Jock Stender, Charleston

~~~~~

The New York Times

Tuesday, October 1, 2013, pg. B1, Business Day

Doubts Raised on Value of Investment Consultants to Pensions

~

By ANDREW ROSS SORKIN

~

Here’s a brainteaser: Would you invest $10,000 in a mutual fund without knowing its past performance? Probably not. Yet, if you were in charge of $13 trillion of pension money, would you accept the recommendation of an investment consultant without knowing its performance record? The answer is yes. It happens every day.

~

Welcome to the bizarre world of pension funds and investment consultants. At a time when individual investors are increasingly demanding transparency in performance track records, the biggest slice of the investment world — pension funds — has conspicuously turned a blind eye to demanding track records from their most influential advisers, investment consultants.

~

A new study by professors at the University of Oxford is causing a stir in the staid pension investment industry, highlighting the subpar performance of most consultants and, more important, the lack of disclosure that would allow the public to even know about it.

~

The study demonstrates, perhaps for the first time, that the investment consultants that pension funds rely on to advise them about what funds and investments they should make — resulting in tens of millions of dollars in fees each year — are, as one of the authors of the survey says, “worthless.”

~

“It’s a waste of money listening to consultants,” Howard Jones, one of the authors of the study, told me he concluded. “It’s a service that is useless.”

~

Mr. Jones and his colleagues, Tim Jenkinson and Jose Vicente Martinez, examined the recommendations of investment consultants from 1999 to 2011 related to United States equities. It culled the data from Greenwich Associates, which had collected it anonymously from 29 firms, representing 91

percent of the entire investment consulting industry’s market share in the United States.

~

The result of the study is nothing short of breathtaking if you’re in the investment management business: “The analysis finds no evidence that the recommendations of the investment consultant for these U.S. equity products enabled investors to outperform their benchmarks or generate alpha,” a measure of performance that adjusts for risk. The study found that, on average, the consultants’ recommendations underperformed their benchmarks by about 1 percent.

~

Those recommendations are worth big fees to the consulting firms. In 2012, Calpers, the big California pension fund, paid $33 million in fees to outside investment consultants. CalSTRS, the California teachers’ fund, spent nearly $9 million. New York State and Local Retirement System spent nearly $7 million. Pennsylvania State Employees’ Retirement System spent about $4 million. The list goes on.

~

The investment consulting industry has always been a powerful force in directing how trillions of dollars are allocated every year to different investment firms and hedge funds, but it has long hidden in the shadows. Pension funds hire the outside consultants to help them determine where to invest their money. “Consultants’ recommendations have a large influence on investor allocation decisions and confirms survey data which reports that manager selection is one of the most highly valued services offered by consultants,” the study found.

~

According to a survey conducted in 2011 by Pensions and Investments, 94 percent of pension funds use a consultant. Of those, nearly a quarter of the pension funds said the recommendation by a consultant was “crucial” to their decision and 40 percent said it was “very important.”

~

Yet the firms don’t disclose their track records. About six firms control about 60 percent of the market, Mr. Jones said. The biggest and most influential investment consultants are Mercer Investment Consulting, Russell Investments, Towers Watson Investment, Cambridge Associates, Hewitt EnnisKnupp, R. V. Kuhns & Associates, Callan Associates, Pension Consulting Alliance, Strategic Investment Solutions and Wilshire Associates. Wilshire has long been a top consultant to Calpers, for example.

~

Why do pension funds use outside investment consultants?

~

“It’s backside-covering,” Mr. Jones said. “It’s easy to say you took expert advice,” saying the rationale is similar to the adage “Nobody got fired for hiring I.B.M.”

~

That may be a bit unfair. There is clearly a place for consultants, who can often introduce pension funds to new asset classes or particular investment managers, a point Mr. Jones made as well. But as investors, consultants are, well, no better than consultants.

~

Mr. Jones’s study said that one reason pension funds don’t hold the consultants accountable for their advice was that they were considered “money doctors with whom investors develop a relationship of trust, and this in turn gives them confidence when they select fund managers.”

~

Still, the lack of transparency on performance track records seems to be a conspicuous hole in the investment process.

~

Somewhat oddly, Andrew Kirton, global chief investment officer at Mercer, was quoted this week in the trade magazine Pensions and Investments defending the lack of transparency.

~

“It’s in our clients’ interest to have the level of transparency that we have. We’re not forced by marketing purposes to give advice we think isn’t the best due to polishing numbers that makes us look better in a survey,” Mr. Kirton said. “You can make yourself potentially a hostage to data.”

~

Mr. Jones said he was perplexed when he read that. “They are not willing to be transparent with their own performance,” he said. “It has to make you very curious about their motivations.”

~

Ultimately, Mr. Jones wrote, the lesson of his research “would be to require investment consultants to provide the same high level of disclosure as that which is provided by fund managers on their performance, or the same level of disclosure provided by research analysts on their stock recommendations.”

~

Andrew Ross Sorkin is the editor at large of DealBook. Twitter: @andrewrsorkin

~

A version of this article appears in print on 10/01/2013, on page B1 of the New York edition with the headline: Doubts Raised On Advice Pensions Get.

~

The URL to this article is http://dealbook.nytimes.com/2013/09/30/doubts-raised-on-value-of-investment-consultants-to-pensions/?_r=0

The incumbents need to be removed, by elections or removal by ethical reasons.

When a ‘bonus’ equals half or approaches the salary of a public

employee, their performance review should be available identifying what

was worth that ‘PIC’!!

ABSOLUTELY!!! These justifications are required by state regulation for them to be paid. FITS you need to FOIA the EPMS (employee performance management system – evaluations) of these people if not exempt/at-will AND especially, the documents which justify the bonuses. There has to be a narrative on why these people make these sums. I understand someone who is performing in a niche job, but not ones that are under-performing, which they are doing. The local media needs to broadcast this and pick it up. I don’t know why they are not. It is almost as bad as the legislative perk no one likes to talk about anymore…. house or senate member for at least eight years, you can then qualify to buy the remainder of your years up to full retirement for 1/20th of what regular state employees would have to pay. And the annual payout is just around 30k for a legislative salary which is half of that. It is astonishing!

Here’s a story you won’t see on Fits: Loftis defends $9 million in attorney’s fees, a chunk of which is going to his longtime bud and fraternity brother: http://www.goupstate.com/article/20130927/WIRE/130929717

Because the story is shit.

The facts are these atty were paid according to the published rate schedule. The AG approved of the fees. A judge approved of the fees.

And the Bank, which had to pay the fees (no tax dollars or retiree money was involved in paying the attys) had to sign off.

Reynolds Williams, the chairman of the commission that is under criminal investigating for making 150,ooo dollars off the fund, is the guy pushing the story. He is issue that someone else made money off the fund other than himself. If you trust that criminal then you should have you head examined.

Sorry. Loftis did not pay according to the fee schedule provided by the AG. I know that for a fact.

The schedule is on the Treasurer’s website.

Look it up, Jack.

And that proves…what?

I have ruled on Reynolds in my very own secret attorney discipline committee and I have told my great friend Hugh that everything is A-O-Kay! He has promised me a few more votes. Now run along and support a Democrat somewhere and leave all of this mess alone.

I am just waiting for Danny Varat to appear on this list. That bowtie boob slithered over there back from PEBA to his lofty perch 1201 Main St. overlooking his former digs at the Statehouse. He is now making 95k and sure he will receive that as a bonus. How ironic he would be calling such bonus amounts as unconscionable himself if he were not part of the group receiving them. Just one of the boys now at the SCRIC running a tab on backs of SC taxpayers despite calling himself a protector of the people’s wallet. Again, it is hypocrisy of the highest order and NO state agency can justify keeping and paying folks those bonuses for the performance that is evidenced.

How should Nancy Mace use this article in a debate with Lindsey Graham to illustrate DOD Contracting and the money being used to fund Syrian “rebels”..?? How should she use this information to make a campaign advertisement to highlight how donors to the Graham campaign have gotten “bonuses”..?

How should readers of this article use this to say “hello” to jurors on what court case right now..?

How should this article be tagged to the comment section of this article in the Post and Courier to say “hello” to Pierre Manigault..?

http://www.postandcourier.com/article/20131002/PC16/131009931/1177/haley-can-appoint-whoever-she-wants-at-the-citadel-and-she-will

Maybe the “Charleston Place Convention gang” will pickup the phone and call WHO…?

Saw Michael at a Columbia market last week. What’s up with that?

Then again, there is that old adage, “you get what you pay for.” Might be applicable here.