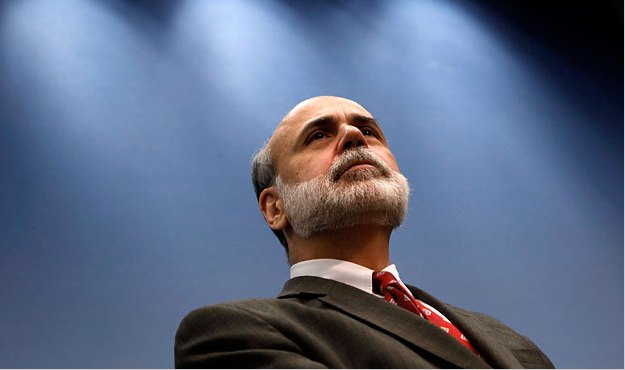

Ben Bernanke’s “Wounded Heart” Economy

Like most of the crappy decisions that have come out of Washington, D.C. this millenium, Federal ResYou must Subscribe or log in to read the rest of this content.

Like most of the crappy decisions that have come out of Washington, D.C. this millenium, Federal Res

32 comments

Ben Bernanke, a SC native, should be nominated for the Order of the Palmetto. Obama and his ilk own the last five years.

I believe Bernanke is acting as he believes 0bama wants him to but he is not putting up any fight for common sense and so I hold it to him also that this economy is so sluggish. He is the perfect patsy to the saying “all that is necessary for the triumph of evil is that good men do nothing”. If Bernanke truly deserved the Order of the Palmetto he would have advised against QE, especially the last two, and resigned if need be.

I believe Bernanke is acting as he believes 0bama wants him to but he is not putting up any fight for common sense

You seriously believe that this isn’t what Bernanke wants? What makes you think that?

I didn’t say Bernanke doesn’t want this, my point was Bernanke does what the boss says; he behaved differently under Bush, not saying it was better or worse. He goes where the wind blows him.

Bernanke is the Boss

Bernanke is the Boss The emperor has no clothes but this time the emperor is aware of it.

U.S. GDP has been boosted by government deficit spending in excess of $1 trillion per year. Removing the temporary effects of extraordinary deficits, U.S. GDP remains negative. Compounding the problem, loose monetary policies, rather than spurring lending to consumers or small businesses, have created inflationary pressures and have lead to stagflation.

Rather than putting Americans back to work, inflationary policies have helped to push prices higher. Based on U.S. Consumer Price Index (CPI), the official inflation rate in the U.S. is roughly 2%, but the CPI does not accurately measure the cost of maintaining a constant standard of living. Using the same methodology as in 1980, the CPI should be 9.3% currently. Rising market prices are not increase in value of shares but rather loss of purchasing power of the dollar. It is the method of reporting inflation by a market using fiat currency as a measuring stick for value

Ben Bernanke, a SC native, should be nominated for the Order of the Palmetto. Obama and his ilk own the last five years.

I believe Bernanke is acting as he believes 0bama wants him to but he is not putting up any fight for common sense and so I hold it to him also that this economy is so sluggish. He is the perfect patsy to the saying “all that is necessary for the triumph of evil is that good men do nothing”. If Bernanke truly deserved the Order of the Palmetto he would have advised against QE, especially the last two, and resigned if need be.

I believe Bernanke is acting as he believes 0bama wants him to but he is not putting up any fight for common sense

You seriously believe that this isn’t what Bernanke wants? What makes you think that?

I didn’t say Bernanke doesn’t want this, my point was Bernanke does what the boss says; he behaved differently under Bush, not saying it was better or worse. He goes where the wind blows him.

Bernanke is the Boss

Bernanke is the Boss The emperor has no clothes but this time the emperor is aware of it.

U.S. GDP has been boosted by government deficit spending in excess of $1 trillion per year. Removing the temporary effects of extraordinary deficits, U.S. GDP remains negative. Compounding the problem, loose monetary policies, rather than spurring lending to consumers or small businesses, have created inflationary pressures and have lead to stagflation.

Rather than putting Americans back to work, inflationary policies have helped to push prices higher. Based on U.S. Consumer Price Index (CPI), the official inflation rate in the U.S. is roughly 2%, but the CPI does not accurately measure the cost of maintaining a constant standard of living. Using the same methodology as in 1980, the CPI should be 9.3% currently. Rising market prices are not increase in value of shares but rather loss of purchasing power of the dollar. It is the method of reporting inflation by a market using fiat currency as a measuring stick for value

The Keynesians will never admit defeat. They will continue

Zimbabwe economics until the bitter end, with MMT proponents claiming everyone else is “uninformed” or worse.

The average Joe doesn’t have a prayer long term.

He’ll get to listen to the gov’t/well paid idiots tell him that his average Joe common sense is malarky and they, the “educated” ones know what’s best for everyone.

It’s sad.

I almost hate to inflict Krugman on this post, but, since he has been right most of the time recently, I thought his views deserve exposure to this forum. Here he is writing about deficits and interest rates in our current economy:

“Most practical men, confronted with the prospect of

unprecedented deficits in the United States, the UK, and elsewhere, extrapolated from their usual experience, in which increased borrowing drives up interest rates. And so there were widespread predictions of sharp rate rises. Most famously, perhaps, Morgan Stanley predicted in late 2009 that interest rates on 10-year US bonds, then around 3.5 percent, would shoot up to 5.5 percent in 2010; in early 2011 Pimco’s legendary head, Bill Gross – who had correctly predicted low rates in 2010 — predicted a rate spike by the summer. And in each case these views were very widely held.

“But economists who knew basic macroeconomic theory –

specifically, the IS-LM model, which was John Hicks’s interpretation of John Maynard Keynes, and at least used to be in the toolkit of every practicing macroeconomist – had a very different take. By late 2008 the United States and other advanced nations were up against the zero lower bound; that is, central banks had cut rates as far as they could, yet their economies remained deeply depressed. And under those conditions it was straightforward to see that deficit spending would not, in fact, raise rates, as long as the spending wasn’t enough to bring the economy back near full employment. It wasn’t that economists had a lot of experience with such situations (although Japan had been in a similar position since the mid-1990s). It was, rather, that economists had special tools, in the form of models, that allowed them to make useful analyses and predictions even in conditions very far from normal experience.

“And those who knew IS-LM and used it – those who understood what a liquidity trap means – got it right, while those with lots of real-world experience were wrong. Morgan Stanley eventually apologized to its investors, as rates not only stayed low but dropped; so, later, did Gross. As I speak, deficits remain near historic highs – and interest rates remain near historic lows.”

Krugman was speaking 12 February 2012 on the occasion of receiving an honorary degree in Lisbon,

I’ll give credit to Krugman calling MMTers to the mat:

“Right now, deficits don’t matter — a point borne out by all the evidence. But there’s a school of thought — the modern monetary theory people — who say that deficits never matter, as long as you have your own currency.

I wish I could agree with that view — and it’s not a fight I especially want, since the clear and present policy danger is from the deficit peacocks of the right. But for the record, it’s just not right.

The key thing to remember is that current conditions — lots of excess capacity in the economy, and a liquidity trap in which short-term government debt carries a roughly zero interest rate — won’t always prevail. As long as those conditions DO prevail, it doesn’t matter how much the Fed increases the monetary base, and it therefore doesn’t matter how much of the deficit is monetized.”

There are times in which Krugman is correct, even if I don’t agree with many of his viewpoints.

The thing that bothers me about Krugman, aside from his bedside manner, is that he likes to argue from both sides of the fence at times.

That being said, what he has done is acknowledge that the RESERVES are what’s keeping a lid on inflation(correctly)…but he has an abstract faith that Bernanke and company will be able to unwind them…selling collateral that is overvalued….

No way.

The Keynesians will never admit defeat. They will continue

Zimbabwe economics until the bitter end, with MMT proponents claiming everyone else is “uninformed” or worse.

The average Joe doesn’t have a prayer long term.

He’ll get to listen to the gov’t/well paid idiots tell him that his average Joe common sense is malarky and they, the “educated” ones know what’s best for everyone.

It’s sad.

I almost hate to inflict Krugman on this post, but, since he has been right most of the time recently, I thought his views deserve exposure to this forum. Here he is writing about deficits and interest rates in our current economy:

“Most practical men, confronted with the prospect of

unprecedented deficits in the United States, the UK, and elsewhere, extrapolated from their usual experience, in which increased borrowing drives up interest rates. And so there were widespread predictions of sharp rate rises. Most famously, perhaps, Morgan Stanley predicted in late 2009 that interest rates on 10-year US bonds, then around 3.5 percent, would shoot up to 5.5 percent in 2010; in early 2011 Pimco’s legendary head, Bill Gross – who had correctly predicted low rates in 2010 — predicted a rate spike by the summer. And in each case these views were very widely held.

“But economists who knew basic macroeconomic theory –

specifically, the IS-LM model, which was John Hicks’s interpretation of John Maynard Keynes, and at least used to be in the toolkit of every practicing macroeconomist – had a very different take. By late 2008 the United States and other advanced nations were up against the zero lower bound; that is, central banks had cut rates as far as they could, yet their economies remained deeply depressed. And under those conditions it was straightforward to see that deficit spending would not, in fact, raise rates, as long as the spending wasn’t enough to bring the economy back near full employment. It wasn’t that economists had a lot of experience with such situations (although Japan had been in a similar position since the mid-1990s). It was, rather, that economists had special tools, in the form of models, that allowed them to make useful analyses and predictions even in conditions very far from normal experience.

“And those who knew IS-LM and used it – those who understood what a liquidity trap means – got it right, while those with lots of real-world experience were wrong. Morgan Stanley eventually apologized to its investors, as rates not only stayed low but dropped; so, later, did Gross. As I speak, deficits remain near historic highs – and interest rates remain near historic lows.”

Krugman was speaking 12 February 2012 on the occasion of receiving an honorary degree in Lisbon,

I’ll give credit to Krugman calling MMTers to the mat:

“Right now, deficits don’t matter — a point borne out by all the evidence. But there’s a school of thought — the modern monetary theory people — who say that deficits never matter, as long as you have your own currency.

I wish I could agree with that view — and it’s not a fight I especially want, since the clear and present policy danger is from the deficit peacocks of the right. But for the record, it’s just not right.

The key thing to remember is that current conditions — lots of excess capacity in the economy, and a liquidity trap in which short-term government debt carries a roughly zero interest rate — won’t always prevail. As long as those conditions DO prevail, it doesn’t matter how much the Fed increases the monetary base, and it therefore doesn’t matter how much of the deficit is monetized.”

There are times in which Krugman is correct, even if I don’t agree with many of his viewpoints.

The thing that bothers me about Krugman, aside from his bedside manner, is that he likes to argue from both sides of the fence at times.

That being said, what he has done is acknowledge that the RESERVES are what’s keeping a lid on inflation(correctly)…but he has an abstract faith that Bernanke and company will be able to unwind them…selling collateral that is overvalued….

No way.

Read “Too Big To Fail.” You might change your tune about interventionism if you really think about what could have happened if we did not intervene. The real question at this point is are we doing what is required to avoid having to intervene again in the future.

Read “Too Big To Fail.” You might change your tune about interventionism if you really think about what could have happened if we did not intervene. The real question at this point is are we doing what is required to avoid having to intervene again in the future.

told ya before. economics is very complex and best left to people willing to read more than blogs. stick to local political rumors. thats what you’re good at.

told ya before. economics is very complex and best left to people willing to read more than blogs. stick to local political rumors. thats what you’re good at.

ha! just read that bill gross line again. hilarious. so Fits thinks we have some common cause with the top floor at PIMCO?

ha! just read that bill gross line again. hilarious. so Fits thinks we have some common cause with the top floor at PIMCO?

While Will constantly cites Zero Hedge, and name-checks PIMCO in this piece, I sure hope for the financial security of his family that he has not been investing by their guidelines.

The Krugman commented, “A while back I noted that macroeconomic analysis at the bond giant Pimco seemed to have gone downhill after Paul McCulley left; a firm that had shown a keen appreciation of the special problems of a deleveraging economy started making really bad analyses based on the notion that the Fed’s quantitative easing was driving everything — and lost a lot of money as a result.”

Dealbreaker (via ZeroHedge) put up a special letter from Gross (head of PIMCO) to his investors titled, simply Mea Culpa.

For those not caught up on Gross’ year, he’s ranked 536 out of 584 bond funds this year, mostly due to the fact he predicted (quite loudly in the press) that the end of QE2 this summer would see yields soar. But they didn’t. Instead, the economy started slowing down right then, and the flight to Treasuries was ON, creaming his bet.

Here’s his mea culpa summed up in one sentence from the letter:

“The simple fact is that the portfolio at midyear was positioned for what we call a “New Normal” developed world economy – 2% real growth and 2% in?ation. When growth estimates quickly changed it was obvious that I had misjudged the ?y ball: E-CF or for non- baseball a?cionados – error center?eld.”

Well, I guess the baseball allusion makes it OK, right?

While Will constantly cites Zero Hedge, and name-checks PIMCO in this piece, I sure hope for the financial security of his family that he has not been investing by their guidelines.

The Krugman commented, “A while back I noted that macroeconomic analysis at the bond giant Pimco seemed to have gone downhill after Paul McCulley left; a firm that had shown a keen appreciation of the special problems of a deleveraging economy started making really bad analyses based on the notion that the Fed’s quantitative easing was driving everything — and lost a lot of money as a result.”

Dealbreaker (via ZeroHedge) put up a special letter from Gross (head of PIMCO) to his investors titled, simply Mea Culpa.

For those not caught up on Gross’ year, he’s ranked 536 out of 584 bond funds this year, mostly due to the fact he predicted (quite loudly in the press) that the end of QE2 this summer would see yields soar. But they didn’t. Instead, the economy started slowing down right then, and the flight to Treasuries was ON, creaming his bet.

Here’s his mea culpa summed up in one sentence from the letter:

“The simple fact is that the portfolio at midyear was positioned for what we call a “New Normal” developed world economy – 2% real growth and 2% in?ation. When growth estimates quickly changed it was obvious that I had misjudged the ?y ball: E-CF or for non- baseball a?cionados – error center?eld.”

Well, I guess the baseball allusion makes it OK, right?

Actually I read Zero Hedge daily and they have good information there. There is a lot of governmental interference in the markets/financial sector that is corrupting normal business decisions. Europe is already starting to feel the affects and it is a matter of time before we experience those negative affects also.

Actually I read Zero Hedge daily and they have good information there. There is a lot of governmental interference in the markets/financial sector that is corrupting normal business decisions. Europe is already starting to feel the affects and it is a matter of time before we experience those negative affects also.

Bernanke is floating the debt Congress gives him as best he can. I don’t think it has much to do with economic recovery, except vis a vis our wacky stimulous. And gross can’t make much investment income for his fund while rates are low. It may or may not be the BEST time to be super rich, but when has it been bad compared to the other options?

Bernanke is floating the debt Congress gives him as best he can. I don’t think it has much to do with economic recovery, except vis a vis our wacky stimulous. And gross can’t make much investment income for his fund while rates are low. It may or may not be the BEST time to be super rich, but when has it been bad compared to the other options?

Bernanke is the Boss and owns Congress

U.S. GDP has been boosted by government deficit spending in excess of $1 trillion per year. Removing the temporary effects of extraordinary deficits, U.S. GDP remains negative. Compounding the problem, loose monetary policies, rather than spurring lending to consumers or small businesses, have created inflationary pressures and have lead to stagflation.

Rather than putting Americans back to work, inflationary policies have helped to push prices higher. Based on U.S. Consumer Price Index (CPI), the official inflation rate in the U.S. is roughly 2%, but the CPI does not accurately measure the cost of maintaining a constant standard of living. Using the same methodology as in 1980, the CPI should be 9.3% currently. Rising market prices are not increase in value of shares but rather loss of purchasing power of the dollar. It is the method of reporting inflation by a market using fiat currency as a measuring stick for value

Bernanke is the Boss and owns Congress

U.S. GDP has been boosted by government deficit spending in excess of $1 trillion per year. Removing the temporary effects of extraordinary deficits, U.S. GDP remains negative. Compounding the problem, loose monetary policies, rather than spurring lending to consumers or small businesses, have created inflationary pressures and have lead to stagflation.

Rather than putting Americans back to work, inflationary policies have helped to push prices higher. Based on U.S. Consumer Price Index (CPI), the official inflation rate in the U.S. is roughly 2%, but the CPI does not accurately measure the cost of maintaining a constant standard of living. Using the same methodology as in 1980, the CPI should be 9.3% currently. Rising market prices are not increase in value of shares but rather loss of purchasing power of the dollar. It is the method of reporting inflation by a market using fiat currency as a measuring stick for value